Investors were focused on inflation this last week, and the most recent data was stronger than expected. However, soothing comments on the

subject from the Fed helped calm investor concerns, and mortgage rates ended the week nearly unchanged.

CPI at its highest level since 1991.

In June, the core Consumer Price Index, a closely watched inflation indicator that excludes the volatile food and energy components, surged 0.9% from May, above the consensus forecast for an increase of just 0.5%. Substantial gains were seen in prices for items affected by the pandemic, such as used cars and airline tickets. Core CPI was 4.5% higher than a year ago, up from an annual rate of increase of just 1.6% in March and the highest level since 1991.

Fed comments do not point to a rise in interest rates.

During his semiannual testimony to Congress, Fed Chair Powell suggested that it was too soon to begin to tighten monetary policy and that achieving sufficient progress toward full employment was still “a ways off.” He acknowledged that inflation has

climbed substantially and “will likely remain elevated” in the coming months. Still, he expects it to moderate over time as imbalances caused by the pandemic ease. Investors viewed Powell’s patient attitude toward inflation to indicate that the Fed is not

in a hurry to scale back its bond purchase program, which was good news for mortgage rates.

Retail sales were unexpectedly up in June.

Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key indicator of growth. In June, retail sales rose 0.6% from May, far above the consensus forecast for a moderate decline. Sales were 18%

higher than a year ago and well above the levels seen before the pandemic. The strong results were even more impressive in light of current conditions.

First, a shortage of new vehicles due to a lack of chips and other components held back auto sales. In addition, consumers have been shifting their spending from goods, which are included in retail sales, to services such as travel and entertainment,

which are not.

Major Economic News Due This Week

Looking ahead, investors will closely watch Covid case counts around the world. They also will look for hints from Fed officials about the timing for changes in monetary policy. Beyond that, it will be a very light week for economic reports with a focus on the housing market. Housing Starts will be released tomorrow and Existing Home Sales on Thursday.

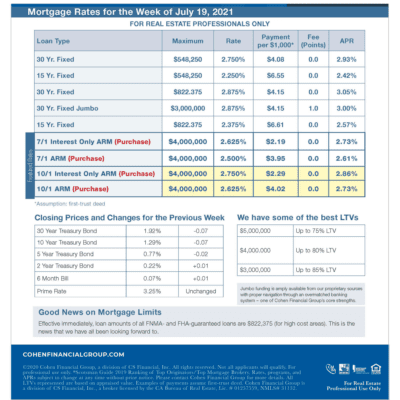

mortgage rates week of 7-19-21