Fed Had Little Impact on Mortgage Rates

The major economic data released last week was roughly in line with the expected levels and caused little reaction. Tough talk from the Fed on fighting inflation also had little impact, and mortgage rates ended the week a bit lower.

Retail Sales Climb Year Over Year

In April, retail sales rose a substantial 0.9% from March and were 8% higher than last year at this time. After being hit especially hard by the pandemic, bar and restaurant sales continued their steady recovery with solid gains in April and were an impressive 20% higher than a year ago. Despite rising prices, consumer spending has been extremely strong so far this year.

Small Decline in April Home Sales

Sales of existing homes in April posted an expected small decline from March to the lowest level since June 2020 and were 6% lower than last year at this time. Inventory levels, down 10% from a year ago, continued to be a major headwind, at just a 2.2-month supply nationally. This remained far below the 6-month supply which is considered a healthy balance between buyers and sellers. The ever-climbing median existing-home price was 15% higher than last year at this time at a record $391,200.

Housing Starts Hit 16 Year High

Homebuyers desperately need more inventory in many regions, and the most recent data on housing starts were mixed. In April, overall housing starts decreased slightly from March, falling a bit short of expectations. Single-family starts declined 7% from March but remained well above the levels seen prior to the pandemic. The number of single-family units under construction rose to 815,000, the most since 2006. Once again, builders reported higher prices and shortages of land, materials, and skilled labor as issues holding back a faster pace of construction.

No Hesitation to Raise Fed Rate

In a speech last Tuesday, Fed Chair Powell again stressed that restoring price stability is “an unconditional need.” He firmly stated that the Fed will not hesitate to raise the federal funds as high as needed to bring down inflation and warned that this might lead to an increase in the unemployment rate. According to Powell, “there could be some pain involved” for the economy due to the monetary policy tightening.

Major Economic News Due This Week

Looking ahead, investors will continue to closely follow news on Ukraine and Covid case counts in China. They will also look for additional Fed guidance on the pace of future rate hikes and bond portfolio reduction. Beyond that, New Home Sales will be released on Tuesday. Durable Orders, an important indicator of economic activity, will come out on Wednesday. The core PCE price index, the inflation indicator favored by the Fed, will be released on Friday.

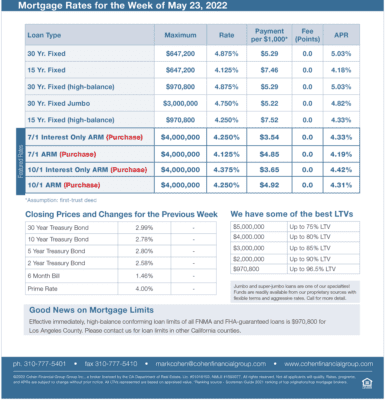

Mortgage rates week of 5-23-2022