Mortgage Rates Climbed to the Highest Levels Since 2010

While it was a light week for economic data, Fed officials continued to talk tough about tightening monetary policy to fight inflation. As a result, mortgage rates climbed to the highest levels since 2010.

Last Thursday, Fed Chair Powell again stressed that it is “absolutely essential” to maintain price stability for the economy to function properly. He expressed support for “front-end loading” the path to the appropriate level of monetary accommodation, meaning that it would be better to reach the target level for the federal funds rate sooner rather than later. According to Powell, a 50 basis point rate hike is an option for the next meeting on May 4, and investors now widely expect it to happen.

Mortgage Sales Experience Small Decline

Higher mortgage rates were a drag on sales of existing homes in March, which posted an expected small decline from February and were 5% lower than last year at this time. Inventory levels, down 10% from a year ago, remained a major headwind, at just a 1.7-month supply nationally. The ever-climbing median existing-home price was 15% higher than last year at this time at a record $375,300.

Homebuyers desperately need more inventory in many regions, and the most recent data on housing starts was mildly encouraging. In March, overall housing starts increased slightly from February to the highest level since 2006, boosted by multi-family units. Single-family starts declined a bit from February but remained well above the levels seen prior to the pandemic. The number of single-family units under construction rose to 811,000, the most since 2006. Builders continued to cite higher prices and shortages of land, materials, and skilled labor as obstacles to a faster pace of construction.

Major Economic News Due This Week

Looking ahead, investors will continue to closely follow news on Ukraine and will look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Beyond that, New Home Sales will be released on Tuesday. First-quarter Gross Domestic Product (GDP), the broadest measure of economic activity, will come out on Thursday. The core PCE price index, the inflation indicator favored by the Fed, will be released on Friday. The next Fed meeting will take place on May 4.

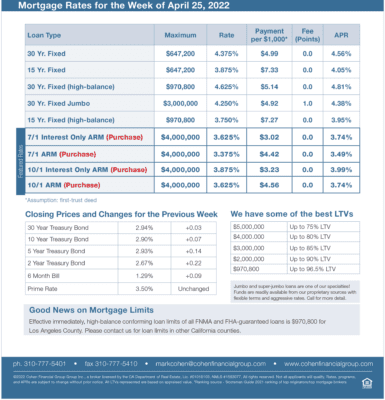

mortgage rates week of 4-25-2022