The shockingly swift increase in mortgage rates continued last week, reaching the highest levels since early 2019. The cause is clear. Inflation has climbed to the highest levels in decades, and the Fed has started to tighten monetary policy to bring inflation back down.

Fed Raises Federal Funds Rate

After indicating for months that they must fight inflation by reversing the extremely accommodative policy measures put in place to boost the economy during the pandemic, the Fed began the process by raising the federal funds rate by 25 basis points at its last meeting on March 16. The main questions going forward now are how quickly and how much the Fed will raise rates. Since the start of the year, investors have shifted from pricing in roughly three rate hikes of 25 basis points each in 2022 up to the equivalent of eight by year-end, in increments of either 25 or 50 basis points at each meeting.

Powell Takes Stance on Inflation

In a speech last Monday just days after the meeting, Fed Chair Powell caught investors off guard by emphasizing the need to more aggressively fight inflation. Powell pledged to “take the necessary steps” to get inflation under control even if it means raising the federal funds rate by more than 25 basis points at a future meeting. He explained that the timing is uncertain for relief from the resolution of supply chain disruptions caused by the pandemic, and the conflict in Ukraine and the recent Covid outbreaks in China will increase inflationary pressures.

Powell also directly addressed investor concerns that the Fed might tighten policy too much, slowing the economy more than necessary to bring down inflation. To recap, the Fed loosens monetary policy to boost the economy during periods of weakness, such as after the start of the pandemic. By contrast, when the economy exceeds a certain capacity, the demand for goods and services becomes so strong that prices must rise to balance supply and demand, eventually forcing the Fed to tighten.

The pandemic and the conflict in Ukraine have made inflation even worse than usual since manufacturing has been heavily constrained and the supply of key commodities is shrinking. Investors use the term “soft landing” to describe implementing the optimal level of tightening which will restrain economic growth just the right amount to bring down inflation without causing an undesirable recession. Powell expressed optimism that the Fed could achieve a reasonably soft landing, and its level of success will heavily influence future mortgage rates.

New Home Inventory Rises

Sales of new homes declined for the second straight month in February, dropping 2% from January to an annualized rate of 772,000, below the consensus forecast of 810,000. The median new-home price was 11% higher than last year at this time at $400,600. Inventory levels unexpectedly rose to 407,000 units, the highest level since 2008, but over 90% of those homes were either under construction or not yet started.

Major Economic News Due This Week

Looking ahead, investors will continue to closely follow news on Ukraine and will look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Beyond that, the core PCE price index, the inflation indicator favored by the Fed, will come out on Thursday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month.

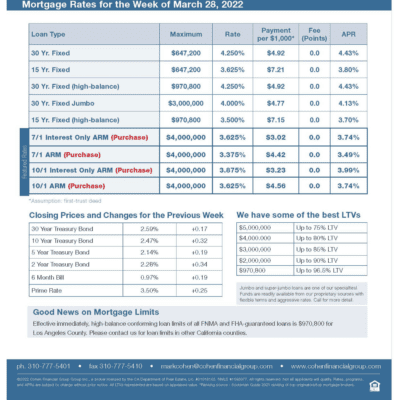

mortgage rates week of 3-28-2022