While investors continued to keep a close eye on the conflict in Ukraine last week, the primary influence on mortgage markets was growing concern about rising inflation and its effect on future Fed policy. At its meeting last Wednesday, the Fed indicated that it plans to tighten monetary policy more than expected, and mortgage rates ended last week higher.

Fed Raises Interest Rates for First Time Since 2018

Fed officials have been indicating for months that they must fight inflation by reversing the extremely accommodative policy measures put in place to boost the economy during the pandemic. As expected, the Fed began the process by raising the federal funds rate by 25 basis points, the first hike since 2018. This caught no one by surprise, and investors instead focused on the projections from officials for the future path of the fed funds rate.

On average, officials forecasted that there will be six additional 25 basis point rate increases by the end of the year, which was at the high end of investor expectations and a much faster pace than anticipated just a few months ago.

Investors also were seeking precise guidance on the plans for reducing the Fed’s massive holdings of Treasuries and mortgage-backed securities (MBS), but none was provided except to say that the framework may be finalized at the next meeting in May. During his press conference following the meeting, Chair Powell emphasized that future policy would be adjusted based on incoming economic data.

Consumer Spending Remains Strong

Since consumer spending accounts for over two-thirds of US economic activity, it is an important indicator of the health of the economy. In February, retail sales rose a weaker than expected 0.3% from January. However, this shortfall was more than offset when the enormous increase of 3.8% seen in January was revised to an even more impressive monthly gain of 4.9%. Despite rising prices, consumer spending has been extremely strong so far this year.

Existing Home Sales Drop

Sales of existing homes were a bit disappointing in February, dropping 7% from January. Inventory levels were down 16% from a year ago, at just a 1.7-month supply nationally, well below the 6-month supply which is considered a healthy balance between buyers and sellers, and very close to the record low level. The ever-climbing median existing-home price was 15% higher than last year at this time at $357,300.

Housing Starts Increases

With the shortage of available homes in many areas, investors have been closely watching the monthly reports on housing starts, and the most recent data contained encouraging news. In February, housing starts unexpectedly increased 7% from January to the highest level since 2006. Higher prices and shortages for land, materials, and skilled labor remained obstacles to a faster pace of construction.

Major Economic News Due This Week

Looking ahead, investors will continue to closely follow news on Ukraine and will look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Beyond that, it will be a light week for economic data. New Home Sales will be released on Wednesday. Durable Orders, an important indicator of economic activity, will come out on Thursday.

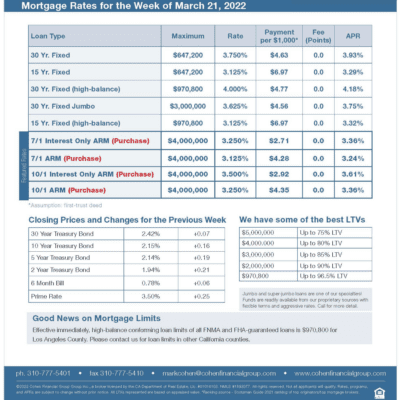

mortgage rates week of 3-21-2022