Headlines about the conflict in Ukraine continued to cause volatility in mortgage markets last week, but their net impact was roughly neutral. Instead, the primary influence was growing concern about rising inflation, and mortgage rates ended last week higher.

Core CPI Hits a 40-Year High

The Consumer Price Index (CPI) is a closely watched inflation indicator that looks at price changes for a broad range of goods and services. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term trend. In February, Core CPI was 6.4% higher than a year ago, up from an annual rate of increase of 6.0% last month, and the highest level since 1982. There are many reasons why the annual core inflation rate has jumped from the readings below 2.0% seen early in 2021, including a tight labor market, strong consumer demand for goods, and supply chain disruptions. Shortages for many items have caused enormous cost increases, such as used car prices which are 41% higher than a year ago. Fed officials and economists are divided about how much the recent spike in inflation will subside as temporary factors caused by the pandemic are resolved.

Job Openings Point to a Strong Labor Market

The JOLTS report measures job openings and labor turnover rates, and the latest data indicated that the labor market remains very tight. At the end of January, there were a massive 11.3 million job openings, down slightly from last month’s record high, and over 4 million more than in January 2020 prior to the pandemic. A high level of job openings reflects a strong labor market, as companies struggle to hire enough workers with the necessary skills. A very large number of employees also willingly left their jobs in January. This is viewed as a sign of labor market strength as well, since people usually quit only if they expect that they can find better jobs.

ECB Moves to Lower Inflation

Faced with skyrocketing prices and the conflict in Ukraine, the European Central Bank (ECB) had to make a very difficult decision at its meeting on Thursday. It chose to prioritize lower inflation over economic growth by announcing that it plans to end its bond purchase program in the third quarter, which was earlier than expected. ECB President Lagarde acknowledged that the conflict in Ukraine will have “a material impact on economic activity,” but had little choice in tightening monetary policy to help bring down inflation.

Major Economic News Due This Week

Looking ahead, investors will continue to closely follow news on Ukraine. Beyond that, the next Fed meeting will take place on Wednesday. Investors widely expect a 25 basis point rate increase and will look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Retail Sales also will be released on Wednesday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key indicator of growth. Housing Starts will come out on Thursday.

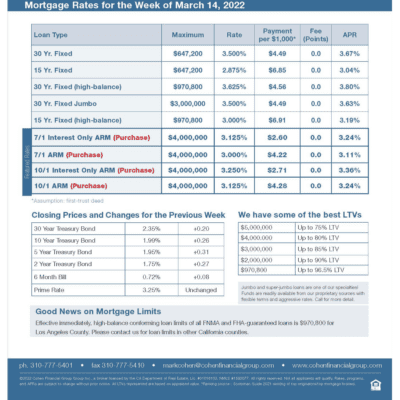

mortgage rates week of 3-14-2022