While the latest inflation report matched expectations, concerns about persistent price increases continued to weigh on investors, and mortgage rates ended last week higher.

Inflation Indicator Hits New High

The core PCE price index is the inflation indicator favored by the Fed. In October, core PCE was 4.1% higher than a year ago, matching the consensus forecast, but up from 3.7% last month and the highest annual rate since 1990. For comparison, readings were below 2.0% during the first three months of the year. Economists have differing views on to what degree higher inflation will be short-lived as pandemic-related disruptions are resolved or persist for years.

In response to this report and other recent signs of higher inflation, investors have continued to move forward their expected timeline for the Fed to raise the federal funds rate. Investors now forecast that there is about a 50% chance that the first rate increase will take place by May and a 50% chance that there will be a second rate hike by the end of next year.

Median Home Price on the Rise Again

Sales of new homes in October were roughly flat from September at an annual rate of 745,000 units, well below the consensus forecast of 800,000, and the results for September were revised lower. The median new home price of $407,700 was up 18% from a year ago, at a record high. In general, the pace of both new and previously owned sales is being dictated by the supply of homes available each month.

Major Economic News Due This Week

Looking ahead, investors will closely watch Covid case counts around the world, particularly in Europe. Beyond that, the key Employment report will be released on December 3, and these figures on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month. The ISM national manufacturing index will come out on December 1 and the ISM national services sector index on December 3.

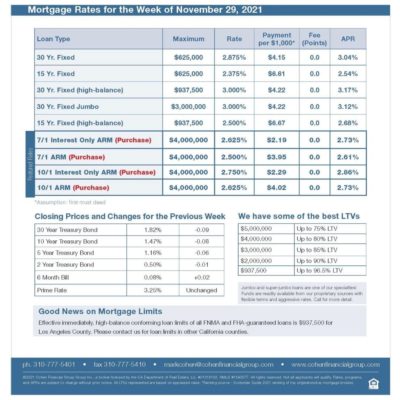

Mortgage Rates week of 11/29/21