There were no significant surprises in the economic data released last week. Inflation held steady from last month and the manufacturing sector remained strong. Mortgage rates ended the week nearly unchanged.

Core PCE Continues to Increase upon Economic Reopening

The core PCE price index is the inflation indicator favored by the Fed. In August, core PCE was 3.6% higher than a year ago, matching the consensus forecast. This was the same annual rate of increase as last month, but up from just 1.5% in February, and the highest annual rate since 1991. While economists have been expecting readings of this magnitude during the reopening of the economy, they have differing views on whether higher inflation will be a temporary spike or persist for years.

ISM Manufacturing Index Above Forecast in Time of Growing Demand

Another significant economic report released last week was from the Institute of Supply Management (ISM). Its national manufacturing index rose to 61.1, which was above the consensus forecast of 59.5. Levels above just 50 indicate that the sector is expanding, and readings above 60 are rare. Of note, a large number of companies reported difficulties in hiring enough workers to keep up with growing demand, and some indicated that supply chain disruptions were holding back production

Major Economic News Due This Week

Looking ahead, investors will closely watch Covid case counts around the world. They also will look for hints from Fed officials about the timing for changes in monetary policy. Beyond that, the key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month. The ISM national service sector index will come out tomorrow.

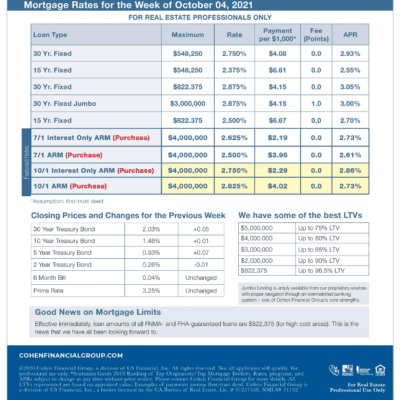

Mortgage rates week of 10-4-21