While the major economic data released last week was roughly in line with expectations overall, investors shifted to riskier assets, which helped stocks and hurt bonds. As a result, mortgage rates ended the week higher.

Unemployment Rate Decreased and Wages Increased in September

The closely watched Employment report released on Friday suggested that the spread of Covid continued to hinder job creation. Against a consensus forecast of 500,000, the economy added just 194,000 jobs in September, similar to August, but down from gains of over one million in July.

However, there were many offsetting factors, such as upward revisions which added 169,000 jobs to the results for prior months. The unemployment rate declined from 5.2% to 4.8%, far below the consensus forecast of 5.1%, and to the lowest level since February 2020. These two components often paint a somewhat different picture because the figures for job gains are calculated from data reported by companies, while the unemployment rate is based on a separate survey of individuals. Average hourly earnings, an indicator of wage growth, rose 0.6% from July, well above the consensus of 0.4%. They were an impressive 4.6% higher than a year ago, up from an annual rate of increase of 4.0% last month.

In addition, education jobs sharply underperformed expectations, but this likely was due to distortions in the seasonal adjustment caused by the pandemic. The data is adjusted to reflect historical seasonal trends such as the start of the school year, and many of the usual hiring and firing patterns have changed during the pandemic. To summarize, job gains fell short partly due to seasonal issues related to the pandemic, while wage gains were very strong, and the report had little net effect on mortgage rates.

ISM National Service Sector Index Nears Record High Despite Circumstances

Another significant economic report released last week was from the Institute of Supply Management (ISM). Its national service sector index rose to 61.9, which was above the consensus forecast of 60.0, and near a record high. Levels above just 50 indicate that the sector is expanding, and readings above 60 are rare. Of note, a large number of companies reported difficulties in hiring enough skilled workers to keep up with growing demand or indicated that supply chain disruptions were holding back production. This could lead to continued strong readings in coming months as companies attempt to catch up.

Major Economic News Due This Week

Looking ahead, investors will closely watch Covid case counts around the world. They also will look for hints from Fed officials about the timing for changes in monetary policy. Beyond that, The Consumer Price Index (CPI) will come out Wednesday CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Retail Sales will be released on Friday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key indicator of growth. Mortgage markets are closed today in observance of Columbus Day.

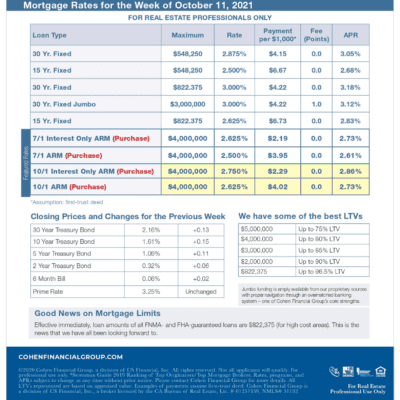

Mortgage rates week of 10-11-21