The key event last week was the Fed meeting on Wednesday and it caused investors to anticipate a faster pace of monetary policy tightening, which was negative for mortgage rates. The major inflation and economic growth data had little impact. As a result, rates climbed a bit to the highest levels since early 2020.

Fed Signals First Interest Rate Hike

As expected, the meeting statement indicated that the Fed soon will be ready to start increasing the federal funds rate for the first time since 2018 to help bring down inflation. In addition, Chair Powell said that their massive balance sheet of mortgage-backed securities (MBS) and Treasuries purchased to aid the economy early in the pandemic is now larger than needed and should be scaled back. While no specific time frame was provided for these policy changes, investors currently anticipate that the first rate hike will occur at the next meeting in March and that balance sheet reduction will begin this summer. Powell also would not provide a target for the total number of rate hikes, but he said that “there’s quite a bit of room to raise interest rates without threatening the labor market.”

Core PCE Index Climbs to 39-Year High

The PCE price index is the inflation indicator favored by the Fed. In December, core PCE was 4.9% higher than a year ago, up from 4.7% last month and the highest annual rate since 1983. For comparison, readings were below 2.0% during the first three months of 2021. One of the big questions for investors is how quickly inflation will moderate as pandemic-related disruptions are resolved.

Fourth Quarter GDP Beats Forecast

Gross domestic product (GDP), the broadest measure of economic activity, was less impacted by the spread of Covid than expected during the final three months of the year. Fourth-quarter GDP showed annualized growth of 6.9%, above the consensus forecast of 5.5%, and up from just 2.3% during the third quarter. Particular strength was seen in consumer spending and inventory replacement. GDP growth for the entire year of 2021 was the highest since 1984, as the economy continued to recover from the effects of the pandemic.

Major Economic News Due This Week

Looking ahead, investors will closely follow news on the omicron variant and will look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Beyond that, the key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month. The ISM national manufacturing index will

come out tomorrow and the ISM national service sector index on Thursday. The next European Central Bank meeting will take place on Thursday.

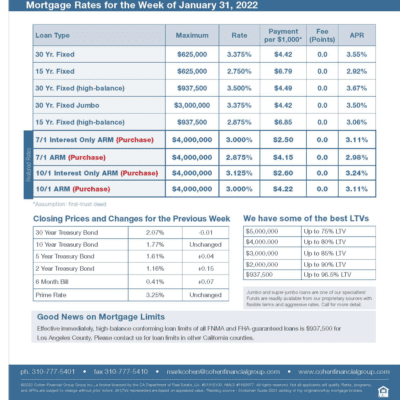

mortgage rates week of 1-31-2022