Last week, the European Central Bank announced the expected policy change in its bond purchase program. The other major economic news contained no surprises, and mortgage rates ended the week with little change.

Bond Buying is Expected to Taper

As expected, the European Central Bank (ECB) announced at last Thursday’s meeting that it will reduce its bond purchases, but it did not specify by exactly how much. Instead, the meeting statement said that it will proceed with a “moderately lower pace” of net asset purchases over the next three months. While the US Fed has not yet begun to taper its bond buying, it is expected to do so before the end of the year.

Job Openings Exceed the Pre-Pandemic Levels

The JOLTS report measures job openings and labor turnover rates, and the latest data indicated that the labor market is extremely tight. At the end of July, job openings unexpectedly surged to 10.9 million, shattering the former record high. Openings are now well over three million higher than they were in January 2020 prior to the pandemic. A high level of job openings reflects a strong labor market, as companies struggle to hire enough workers with the necessary skills.

A large number of employees by historical standards also willingly left their jobs in July. This is viewed as a sign of labor market strength as well, since people usually quit only if they expect that they can find better jobs.

Price Increases near Forecast

The Producer Price Index (PPI) is an inflation indicator for raw material costs for items which are used by producers to make finished products. In August, PPI rose 0.7% from July, which was close to the consensus forecast. PPI was 8.3% higher than a year ago, up from an annual rate of increase of 7.8% last month, and the highest level since 2010. Disruptions to supply chains caused by the pandemic have pushed up prices for many items.

Major Economic News Due This Week

Looking ahead, investors will closely watch Covid case counts around the world. They also will look for hints from Fed officials about the timing for changes in monetary policy. Beyond that, the Consumer Price Index (CPI) will be released tomorrow. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Retail Sales will be released on Thursday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key indicator of growth.

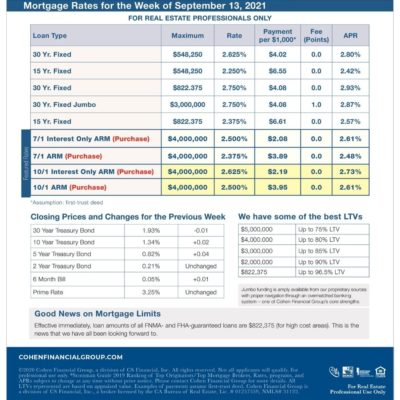

Mortgage rates week of 9-13-2021