With no major economic news, the investor outlook for growth and inflation remained the same last week. Mortgage markets experienced some daily volatility, but rates ended the week with little change.

U.S. Home Inventory Hits s Record Low

After three strong months, sales of existing homes unexpectedly dipped in December, falling 5% from November. However, sales for all of 2021 still were 8.5% higher than in 2020, at the best level since 2006. Inventory levels in December were down 14% from a year ago, at just a 1.8-month supply nationally, well below the 6-month supply which is considered a healthy balance between buyers and sellers, and a record low level. The median existing-home price was 16% higher than last year at this time at $358,000.

Also notable, the mix of homes currently selling has been changing. Sales of homes priced between $100,000 and $250,000 were 23% lower than a year ago. Rising prices and competition from investors have made it more difficult for buyers to find affordable homes, especially at the lower end of the market. By contrast, sales of homes priced between $750,000 and $1,000,000 jumped 32% during that period.

Housing Starts Offer Some Hope for Inventory Starved Market

With the shortage of available homes in many areas, investors have been closely watching the monthly reports on housing starts, and the most recent data was encouraging. In December, housing starts unexpectedly increased from November to the best level since March, and 2021 was the strongest year since 2006. In addition, the number of single-family housing units under construction was at the highest level in almost 15 years. Building permits, a leading indicator of future activity, also beat the consensus forecast, rising to the best level since January 2021.

Higher prices and shortages for land, materials, and skilled labor remained obstacles to a faster pace of construction.

Major Economic News Due This Week

Looking ahead, investors will closely follow news on the omicron variant. The big event will be the Fed meeting on Wednesday, and investors will look for additional guidance on the timing for future rate hikes and balance sheet reduction. Fourth-quarter Gross Domestic Product (GDP), the broadest measure of economic activity, will come out on Thursday. The core PCE price index, the inflation indicator favored by the Fed, will be released on Friday.

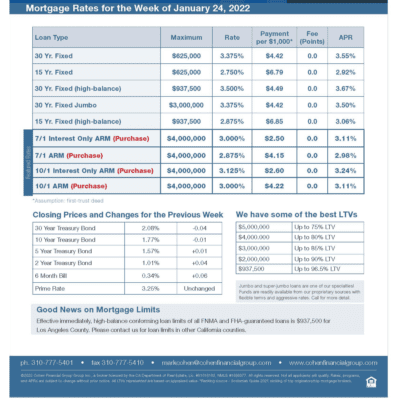

mortgage rates week of 1-24-2022