Mortgage Rates Edge Higher

It was a relatively quiet week last week for mortgage markets. The latest inflation report revealed results that were right in line with expectations. As a result, mortgage rates ended last week slightly higher but remain near the lowest levels of the year.

Core PCE Holds Steady

Fed officials keep a close eye on inflation, and the PCE price index is their favored indicator. In August, Core PCE was 2.9% higher than a year ago, matching expectations, and the same annual rate of increase as last month. Progress toward the 2.0% target of the Fed has not been easy, and this desired level has not been achieved since February 2021.

Existing Home Sales Dip

In August, sales of existing homes fell slightly from July, close to expectations. The median existing-home price of $422,600 was up a slim 2% from last year at this time. Inventories remain stuck at low levels, standing at just a 4.6-month supply nationally, below the roughly 6-month supply typical in a balanced market. However, inventories were 12% higher than a year ago. Homes stayed on the market longer, for an average of 31 days, up from 26 days last year at this time.

New Home Sales Surge

Sales of new homes displayed much better performance in August, surging 21% from July, far exceeding the consensus forecast. Sales were up 15% from a year ago and at the highest level since January 2022. The median new-home price of $413,500 was up 2% from last year at this time. Existing home sales measure actual closing during the month, while new home sales are based on contracts signed, making them a leading indicator of future housing market activity.

Home Building Slows

Finally, the latest home building data was somewhat disappointing. In August, single-family housing starts fell 7% from July to the lowest level since April 2023. Single-family building permits, a leading indicator of future construction, dropped for the sixth straight month to the lowest level since March 2023. A separate survey of home builder sentiment on housing market conditions from the NAHB remained at the lowest level since 2022. According to the NAHB, 65% of builders used sales incentives in September and 39% cut prices, the most since the pandemic.

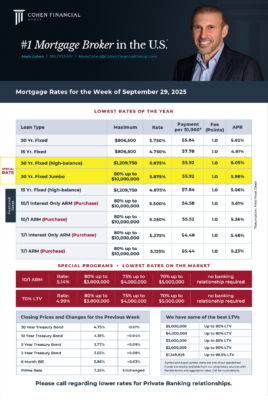

Mortgage Rates for the week of 9-29-2025