Fed Signals Lower Rates Ahead

The Fed meeting last Wednesday confirmed that officials and investors share a similar outlook for a lower federal funds rate. The most significant economic report released last week revealed that consumer spending was much stronger than expected. Mortgage rates ended last week slightly higher but remain near the lowest levels of the year.

Fed Cuts Rates Amid Uncertainty

As expected, the Fed reduced the federal funds rate by 25 basis points. There were no significant surprises in the meeting statement, which continued to emphasize the high level of uncertainty in the economic outlook due to government policy changes. The statement noted the conflicting elements of the dual mandate of the Fed, since the labor market has weakened while inflation has risen. During the press conference following the meeting, Chair Powell described this as “quite an unusual situation,” adding to the challenge for policy makers. Officials are placing more weight on labor market concerns, as their dot plot forecasts revealed average expectations for an additional 50 basis points in rate cuts before the end of the year, but the range of projections between officials was larger than usual. Investors anticipate 25 basis point rate cuts at each of the two remaining meetings this year.

Retail Sales Beat Expectations

Consumer spending accounts for over two-thirds of U.S. economic activity, so the monthly Retail Sales report is a key measure of the health of the economy. While some investors have been concerned that consumers may scale back due to economic uncertainty, it has not happened so far this year. Retail sales in August jumped 0.6% from July, double the consensus forecast of 0.3%, and they were an impressive 5% higher than a year ago. Particular strength was seen in motor vehicles, restaurants/bars, and apparel.

Mortgage Applications Surge

Lower rates were beneficial for mortgage applications again last week, according to the Mortgage Bankers Association (MBA). Applications to refinance jumped 58% from the prior week and were a massive 70% higher than one year ago. The average loan size for refinances rose to a record high. The share of adjustable-rate mortgages (ARM) for refinances climbed to 12.9% of total applications, the highest level since 2008. Purchase applications increased 3% from the prior week and were up 20% from last year at this time.

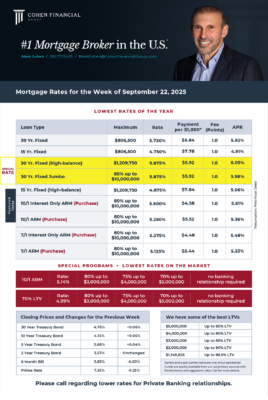

Mortgage Rates for the week of 9-22-2025