The driving force behind the movement in mortgage rates in recent months is clear, and the latest news was not favorable. In the highly anticipated CPI report, inflation was much higher than expected, and mortgage rates predictably climbed.

Core CPI Surprises Investors

The Consumer Price Index (CPI) is a closely watched inflation indicator that looks at price changes for a broad range of goods and services. In August, CPI was 8.3% higher than a year ago, well above the consensus forecast of 8.0%. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term trend. Core CPI in August was up 6.3% from a year ago, also far above the consensus forecast, and near the peak of 6.5% in March, the highest since 1982.

The Core CPI annual rate remains far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Food prices were 11% higher than a year ago, and airline fares were an enormous 33% higher than last year at this time. To help bring down price increases, investors anticipate that the Fed will raise the federal funds rate by 75 basis points at the meeting this week, with a modest chance for an increase of 100 basis points.

Lower Gas Prices Triggers Spending by Consumers

Since consumer spending accounts for over two-thirds of US economic activity, it is an important indicator of the health of the economy. In August, retail sales increased 0.3% from July, better than the consensus forecast for a slight decline. While the dollar value of gas sales fell due to lower gas prices, consumers used their savings to purchase other items. Of note, motor vehicle sales jumped a massive 2.8% from July, and spending at bars at restaurants rose a strong 1.1%. In contrast, sales at furniture stores posted significant declines.

Mortgage Rates Continue to Rise

Higher mortgage rates have taken a large toll on mortgage application volumes, which are now at the lowest levels in decades. According to the latest data from the Mortgage Bankers Association (MBA), average 30-year fixed rates are roughly double what they were a year ago. Purchase applications are down 29% from last year at this time, and applications to refinance a loan have plunged a shocking 83% from one year ago.

Major Economic News Due This Week

Going forward, the next Fed meeting will take place on Wednesday. Investors expect another large increase in the federal funds rate and are hoping for more specific guidance on the pace of future rate hikes and bond portfolio reduction. In addition, Housing Starts will be released on Tuesday and Existing Home Sales on Wednesday.

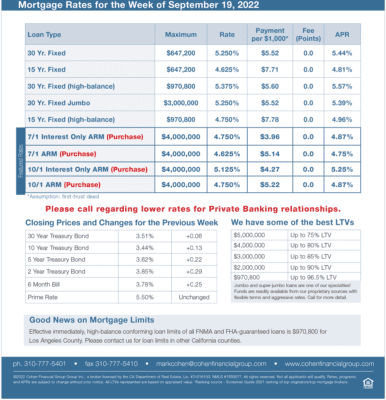

mortgage rates week of 9-19-2022