Energy Prices Rise

The major inflation data released last week was heavily influenced by higher energy prices, but it was essentially in line with expectations. Similarly, consumer spending reflected the increase in gas prices and revealed no significant surprises in other areas. Mortgage rates ended last week slightly higher.

Core CPI Up

The Consumer Price Index (CPI) is one of the most widely followed inflation indicators. In August, CPI jumped 0.6% from July mostly due to higher energy prices. To reduce short-term volatility in the reading and get a better sense of the underlying inflation trend, investors often prefer to look at core CPI, which excludes the food and energy components. In August, core CPI rose just 0.3% from July and was 4.3% higher than a year ago, down from 4.7% last month.

Progress in Inflation Battle Slows

While the core CPI annual rate has fallen from a peak of 6.6% in September 2022, it remains far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Progress in the battle against inflation has been slow due to persistently high prices in certain areas. In particular, shelter (housing) costs remained elevated and again were responsible for the largest portion of the increase.

Consumer Spending Remains Strong

Despite higher prices and credit card rates, consumer spending has remained surprisingly strong. In August, retail sales surged 0.6% from July, far above the consensus for an increase of just 0.2%. However, nearly all of the excess gains came from sales of gasoline, where prices at the pump climbed sharply. Beyond that, the strongest rise in spending was seen at clothing and electronics stores. Sales at restaurants and bars again posted gains, but by the smallest amount in five months.

ECB Raises Interest Rates

On Thursday, the European Central Bank (ECB) raised benchmark interest rates by 25 basis points to help bring down inflation. Ten consecutive hikes have now brought rates in Europe from negative levels to a record high. The bigger story, though, was the meeting statement which indicated that this was anticipated to be the last rate increase in the current cycle. According to the statement, rates have reached levels which will make a “substantial contribution” to bringing inflation back down to target levels over time. In short, rates in Europe are likely to be held at current levels for a while.

Major Economic News Due This Week

The next Fed meeting will take place on Wednesday. No change in the federal funds rate is expected, but investors will seek guidance on whether another increase is expected later in the year. It will be a light week for economic data. Housing Starts will be released on Tuesday and Existing Home Sales on Thursday.

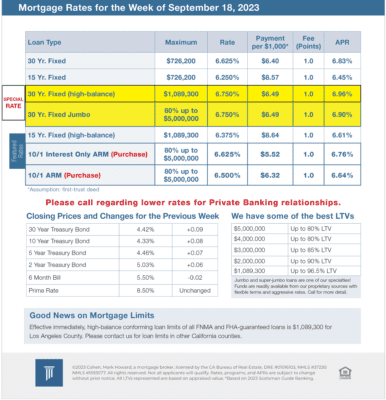

Mortgage Rates for the week of 9-18-2023