Weak Inflation Keeps Rates Low

The two important inflation reports released last week were on balance weaker than expected. As a result, mortgage rates remained near the lowest levels of the year.

August Core CPI Holds Steady

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. Since it excludes food and energy prices, which are prone to short-term volatility, investors tend to focus on core CPI to get a clearer sense of the long-term inflation trend. In August, Core CPI rose 0.3% from July, matching the consensus forecast. It was 3.1% higher than a year ago, the same as last month and the highest annual rate since February.

Core PPI Eases

Another significant inflation indicator released last week, which measures costs for producers, came in far below the expected levels. The August Producer Price Index (PPI) declined 0.1% from July, while the consensus forecast called for an increase of 0.3%. This followed a shockingly large increase of 0.9% last month, however, leading some economists to suggest that tariffs have increased the monthly volatility in this data. In any case, Core PPI was 2.8% higher than a year ago, down sharply from an annual rate of 3.7% last month, which was the highest level since March. Both CPI and PPI remain well above the 2.0% target level of the Fed. Of the two major inflation reports, investors tend to place less weight on PPI, since it reflects a smaller slice of the economy than CPI. Following the latest inflation data, investors now anticipate that the Fed will reduce the federal funds rate by 75 basis points over the remaining meetings this year.

ECB Holds Rates Steady

Last Thursday, the European Central Bank (ECB) held benchmark interest rates unchanged at 2.0%, down from a record high of 4.0% in the middle of 2023. This move was widely anticipated, and the reaction was minor. In its meeting statement, the ECB said that the outlook for inflation remains “more uncertain than usual” due to trade disputes, while the risks to economic growth are more balanced than at the last meeting.

Mortgage Applications Jump

Lower rates were good news for mortgage applications last week, according to the Mortgage Bankers Association (MBA). Applications to refinance rose 12% from last week and were 34% higher than one year ago. Purchase applications increased 7% from the prior week and were up 23% from last year at this time, at the highest level since July.

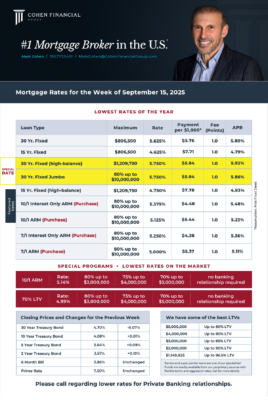

Mortgage Rates for the week of 9-15-2025