During a light week last week for economic data, investors were focused on the U.S. and European central bankers. There were no surprises from the European Central Bank (ECB) or U.S. Fed Chair Powell, however, and mortgage rates ended the week with little change.

ECB Rates at Highest Since 2011

With inflation surging to decade highs, the ECB raised interest rates by a massive 75 basis points to the highest levels since 2011. The latest readings showed inflation in the eurozone at an annual rate above 9%, far above the target level of the ECB of 2%. ECB chief Lagarde explained that the increase in rates was necessary because inflation is likely to stay above the target for “an extended period.” Investors expect additional 50 basis point rate hikes at the next two meetings.

Investors Anticipate Another Fed Rate Hike

Last Thursday, Fed Chair Powell repeated that he is “strongly committed” to fighting inflation. He emphasized the importance of reducing inflation before the public starts to view higher levels as normal and makes future plans based on it. According to Powell, Fed officials hope that higher rates will bring the strong labor market back into “better balance” to reduce outsized wage increases and lessen inflationary pressures. Investors anticipate a 75 basis point rate hike at the next meeting on September 21.

Consumers Choosing Services Over Goods

The most significant economic report released last week from the Institute of Supply Management (ISM) provided additional evidence that consumers are shifting their spending from goods to services. The national services sector index rose to 56.9, which was stronger than expected. Levels above 50 indicate that the sector is expanding.

Major Economic News Due This Week

Going forward, investors are hoping for more specific Fed guidance on the pace of future rate hikes and bond portfolio reduction. The Consumer Price Index (CPI) will be released on Tuesday. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Retail Sales will be released on Thursday. Since consumer spending accounts for over two-thirds of U.S. economic activity, retail sales data is a key measure of the health of the economy. Import Prices also will come out on Thursday.

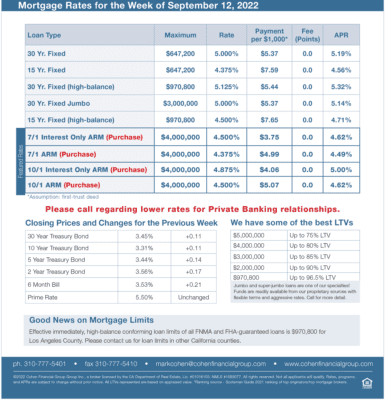

mortgage rates week of 9-12-2022