Powell Warns – May Raise Fed Rate Again

Neither a speech from Fed Chair Powell nor the economic data caused much reaction last week. Mortgage rates ended a little higher. In a highly anticipated speech from the Jackson Hole economic summit, Fed Chair Powell warned that the consequences of not fighting inflation aggressively enough would be worse than the effects of tighter monetary policy, which could include “some pain” for households and businesses. He repeated that future decisions will be based on incoming economic data without providing more specific guidance. Investors remain divided about whether the Fed will raise the federal funds rate by 50 or 75 basis points at the next meeting on September 21.

Core PCE Up 4.6%

The PCE price index is the inflation indicator favored by the Fed. In July, core PCE was up 4.6% from a year ago, a little less than expected, and down from a peak of 5.3% in February. For comparison, the annual rate of increase was below the Fed’s target level of 2.0% during the first three months of 2021. One of the key questions for investors is how quickly monetary policy tightening will bring down inflation.

Home Sales Down – Lowest Since 2016

Higher mortgage rates have remained an obstacle for housing market activity. Sales of new homes peaked in January 2021 at an annualized rate of 993,000. In July, they fell 13% from June to just 511,000, the lowest level since January 2016, and were a shocking 30% lower than last year at this time. The median price of a new home was 8% higher than a year ago at $439,400. As a result of rising prices and mortgage rates, the cancellation rate for contracts to purchase new homes has surged in recent months.

Major Economic News Due This Week

Looking ahead, investors will watch for additional Fed guidance on the pace of future rate hikes and bond portfolio reduction. Beyond that, the ISM national manufacturing sector index will come out on Thursday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be the most highly anticipated economic data of the month.

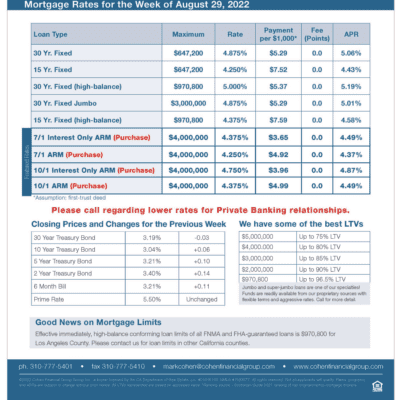

mortgage rates week of 8-29-2022