Mortgage Rates at Highest Levels in Decades

Heading into the highly anticipated speech from Fed Chair Powell on Friday, mortgage markets were essentially unchanged last week. In contrast to the largely negative reaction last year, there was little movement this time, and mortgage rates remain near their highest levels in decades.

Inflation Still Too High

Powell revealed no significant new information to guide investors on future monetary policy. Investors are trying to figure out whether there will be another increase in the federal funds rate later this year. Still, Powell continued to emphasize that decisions will be based on incoming economic data. While encouraged by the downward trend, he said that inflation still “remains too high” and that officials are prepared to raise rates further “if appropriate” until they are confident that inflation is moving down toward their target level. Since there are risks to both tightening monetary policy too much and too little, Powell said that the Fed will proceed carefully in evaluating changing economic conditions.

New Home Sales Up Unexpectedly

In housing news, sales of existing homes in July fell slightly from June and were 17% lower than last year at this time. This was the slowest sales pace for July since 2010. Inventory levels stand at just a 3.3-month supply nationally, far below the 6-month supply typical in a balanced market, and were 15% lower than a year ago. Benefiting from a lack of available existing homes, sales of new homes in July unexpectedly rose 4% from June to their best level since February 2022 and were 32% higher than last year at this time.

High Mortgage Rates Trigger Low Application Volume

Higher rates have caused mortgage application volumes to fall to the lowest levels in 28 years. According to the latest data from the Mortgage Bankers Association (MBA), purchase applications are down 30% from last year at this time, and applications to refinance are down 35% from one year ago. Of note, more buyers are turning to adjustable-rate mortgages in an effort to reduce monthly payments.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, the JOLTS report, measuring job openings and labor turnover rates, will be released on Tuesday. Personal Income and the PCE price index, the inflation indicator favored by the Fed, will come out on Thursday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month.

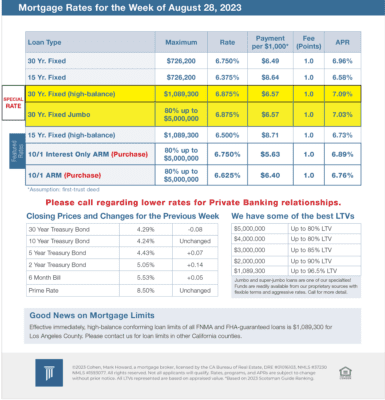

Mortgage Rates for the week of 8-28-2023