Labor Market Data May Trigger Monetary Policy Tightening

The major economic data released last week revealed that the labor market remains tight, supporting the case for even more monetary policy tightening from the Fed. As a result, mortgage rates climbed to the highest levels of the year.

Wage Growth Remains Strong

The latest key Employment report contained mixed news for mortgage markets. While job growth may be slowing from its recent rapid pace back to more typical levels, the unemployment rate is extremely low and wage growth remains strong. The economy added just 187,000 jobs in July, below the consensus forecast of 200,000, and negative revisions reduced the results for prior months. This marked the second month in a row with gains below 200,000, the smallest monthly increases since December 2020.

Fed Keeping Close Eye on Wage Growth

While job growth fell a bit short, the other major components of the report were a little stronger than the forecasts from economists. The unemployment rate unexpectedly declined from 3.6% to 3.5%. Average hourly earnings, an indicator of wage growth, increased 0.4% from June, slightly above the consensus forecast of 0.3%. Earnings were 4.4% higher than a year ago, the same annual rate of increase as last month. Fed officials keep a close eye on wage growth because it generally raises future inflationary pressures. Investors are now split about whether the Fed will increase the federal funds rate by another 25 basis points later this year.

No Change in Consumer Choosing Services Over Goods

Two other significant economic reports released last week from the Institute of Supply Management revealed starkly different results. The ISM national services sector index came in at a solid reading of 52.7. By contrast, the ISM national manufacturing index was just 46.4, up slightly from the lowest level since May 2020. Since readings above 50 indicate an expansion in the sector and below 50 a contraction, this data continues to highlight the consumer preference for services over goods in recent months.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic data, the most highly anticipated report will be the Consumer Price Index (CPI) on Thursday. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Beyond that, the Trade Balance will be released on Tuesday and the Producer Price Index (PPI) on Friday.

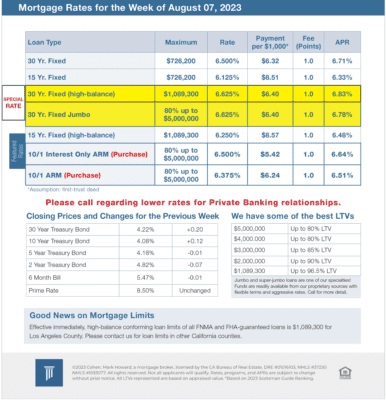

Mortgage Rates for the week of 8-07-2023