Volatility for Mortgage Markets

Given the release of key economic data and a Fed meeting, not surprisingly it was a volatile week last week for mortgage markets. The daily movements were roughly offsetting, however, and mortgage rates ended just slightly higher.

Fed Pauses Federal Funds Rate Hikes

After rapidly raising the federal funds rate by 500 basis points over the prior ten meetings, Fed officials had been hinting in recent weeks that they were almost done and that it was time to slow down. Given this, investors were expecting the Fed to make no change in the federal funds rate this week while leaving the door open for just one more 25 basis point increase at a future meeting. The Fed did in fact “pause” to allow more time to assess the effects of the tightening done over the prior ten meetings. Beyond that, however, officials were more hawkish (in favor of tighter monetary policy) than expected. In particular, the forecasts from officials projected that there will be two more 25 basis point rate hikes this year and that rates will stay higher for longer than anticipated.

The Decline in Energy Prices Drop Inflation Rates

In May, the Consumer Price Index (CPI), one of the most widely followed inflation indicators, was 4.0% higher than a year ago, matching the consensus forecast and down from an annual rate of 4.9% last month. This was the smallest annual rate of increase since March 2021. A massive decline in energy prices was the primary reason for the drop in the annual inflation rate.

To reduce short-term volatility and get a better sense of the underlying trend, investors often prefer to look at core CPI, which excludes the food and energy components. In May, core CPI was 5.3% higher than a year ago, also matching the consensus forecast. While this annual rate has fallen from a peak of 6.6% in September 2022, it remains far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed.

Services Sector Remains Strong

Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a closely watched measure of the health of the economy. In May, retail sales rose a moderate 0.3% from April, above the consensus forecast for a slight decline. Looking at the details, restaurants and bars posted another strong month. In addition, the spring season was kind to home improvement stores, as sales of building materials and garden equipment jumped a massive 2.2%.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. It will be a light week for economic data with a focus on the housing sector. Housing Starts will be released on Tuesday and Existing Home Sales on Thursday. Mortgage markets will be closed on Monday in observance of Juneteenth.

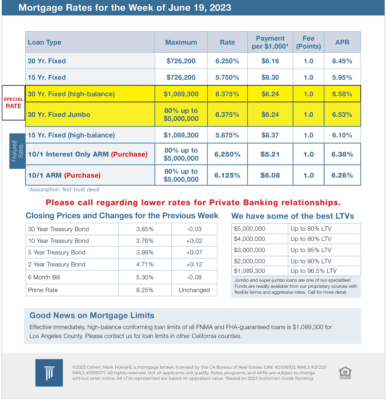

Mortgage Rates for the week of 6-19-2023