Inflation at Highest Levels in Decades

Inflation remained the focus for investors last week, and the latest readings came in stronger than expected, at or near the highest levels in decades. The European Central Bank also revealed a more aggressive stance to fight inflation. As a result, mortgage rates ended last week higher.

Clearer Picture of the Longer-Term Inflation Trend

The Consumer Price Index (CPI) is a closely watched inflation indicator that looks at price changes for a broad range of goods and services. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term trend. In May, Core CPI was 6.0% higher than a year ago, down from an annual rate of increase of 6.2% last month, but still far above the readings around 2.0% seen early in 2021.

Supply Chain Disruptions Will Ease Over Time

As the economy has steadily recovered from the pandemic, strong consumer demand, supply constraints, and surging commodity prices have pushed prices much higher for a wide range of goods and services. The conflict in Ukraine and the recent shutdowns in China due to Covid have worsened shortages for many key items. Over time, supply chain disruptions will ease, and Fed tightening will reduce inflationary pressures, but it is not clear how quickly this will occur.

ECB to Raise Rates

At its meeting on last Thursday, the European Central Bank (ECB) announced that it intends to raise interest rates by 25-basis points at its next meeting in July. It also plans to hike rates again in September by either 25 or 50-basis points depending on whether prices show signs of easing by then. One primary reason for its monetary policy tightening is that inflation in the eurozone reached a record high in May. The ECB also significantly raised its forecast for annual inflation for 2022 from 5.1% to 6.8%.

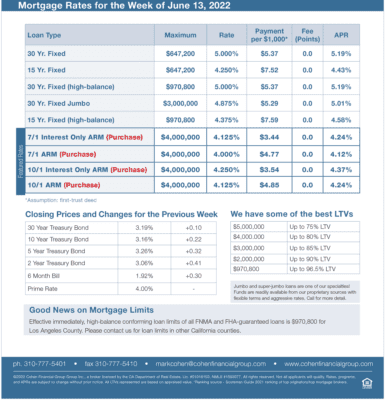

Mortgage Applications Drop

In recent months, higher mortgage rates have taken a large toll on mortgage application volumes, which have dropped to the lowest levels in 22 years. According to the latest data from the Mortgage Bankers Association (MBA), average 30-year fixed rates are over 2.0% higher than a year ago. Purchase applications are down 21% from last year at this time, and applications to refinance a loan have plunged a shocking 75% from one year ago. The MBA now forecasts that total mortgage originations this year will be over 35% lower than last year due to the massive decline in refinancings.

Major Economic News Due This Week

Looking ahead, investors will continue to closely follow news on Ukraine and Covid case counts in China. The next Fed meeting will take place on Wednesday. A 50-basis point rate hike is expected, and investors will be looking for additional Fed guidance on the pace of future rate hikes and bond portfolio reduction. Beyond that, Retail Sales will also be released on Wednesday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key indicator of the health of the economy. Housing Starts will come out on Thursday.