Investors Shifting to Safer Assets

Investors continued to become less concerned about bank troubles and the debt ceiling talks last week. After responding to the initial increase in uncertainty in these areas by shifting to safer assets such as bonds, the opposite took place last week, which was negative for mortgage rates. In addition, the latest inflation data was higher than expected. As a result, rates climbed to the highest levels since early March before the banking industry troubles emerged.

Core PCE Above Fed Targets

The PCE price index is the inflation indicator favored by the Fed. In April, core PCE, which excludes food and energy to reduce volatility, was up 4.7% from a year ago, a little above the consensus forecast, and up from an annual rate of 4.6% last month. The cost of services continued to increase more than prices for goods.

The annual rate of increase in Core PCE remains far above the Fed’s target level of 2.0%. After peaking in September, many investors thought that it would continue to ease every month, but progress quickly stalled. Core PCE is still increasing at the same annual rate of 4.7% seen in November. This is particularly relevant because how quickly aggressive Fed monetary policy tightening will bring down inflation has enormous implications for financial markets.

Buyers Turning to New Home Market

In housing news, sales of new homes in April increased 4% from March to their best level since March 2022 and were 12% higher than last year at this time. A severe shortage of previously owned homes available for sale is causing many buyers to turn to the new home market. The median new-home price of $420,800 is 8% lower than a year ago.

Fed Uncertain of Another Increase in June

The minutes from the May 3 Fed meeting released on last Wednesday contained no significant surprises and caused little reaction for mortgage markets. There was no additional guidance on whether there will be another increase in the federal funds rate at the next meeting on June 14. In fact, the minutes explicitly emphasized the desire of officials to “retain optionality” so that they will be free to make this decision based on evolving factors. Some officials stressed that progress in bringing down inflation was too slow, while others focused on the enormous amount of tightening already done and the long lags involved in feeling the effects on the economy. They also noted the increased uncertainty caused by bank troubles and the debt ceiling talks.

Major Economic News Due This Week

Investors will continue to keep a close eye on the debt ceiling negotiations and banking sector troubles. They will also watch to see if Fed officials elaborate on their plans for future monetary policy. For economic reports, the ISM national manufacturing index will come out on Thursday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month. Mortgage markets were closed on Monday in observance of Memorial Day.

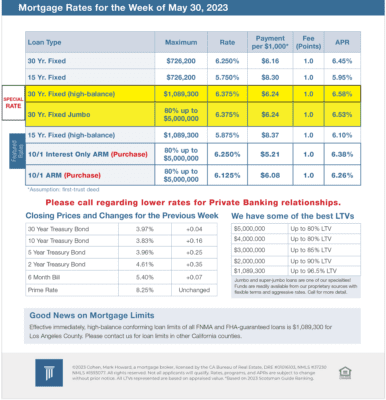

Mortgage Rates for the week of 5-30-2023