Mortgage Rates Drop

Weaker than expected economic data was favorable for mortgage markets last week. The Fed meeting on Wednesday caused some volatility but had little net impact. As a result, rates ended last week lower, dropping from their highest levels of the year.

Modest Labor Market

Following four months of significantly stronger gains, the economy added a more modest 175,000 jobs in April, below the consensus forecast of 240,000. The largest increases were seen in the healthcare, social assistance, and retail sectors. For perspective, the April results were still strong by historical standards, but investors reacted to the deviation from their expectations.

Employment Data Falls Short

The other major components of the Employment report also fell short of forecasts. The unemployment rate unexpectedly rose from 3.8% to 3.9%, matching the highest level since January 2022. Average hourly earnings were 3.9% higher than a year ago, down from 4.1% last month, and stand at the lowest annual rate of increase since May 2021. Fed officials carefully monitor wage growth because it generally raises future inflationary pressures.

Manufacturing and Service Index Dropped

Two other significant economic reports released last week from the Institute of Supply Management revealed similar weakness. The ISM national services sector index fell to 49.4 (lowest since December 2022), and the national manufacturing index dropped to 49.2, both well below their consensus forecasts. Readings below 50 indicate contraction in the sectors.

Fed Maintains Status Quo – No Change for Fed Funds Rate

Heading into the Fed meeting, investors wondered how officials would respond to higher than expected inflation data during the first few months of the year. The answer is that they essentially plan to maintain the status quo. As expected, the Fed again made no change in the federal funds rate. The statement released after the meeting continued to say that officials want to gain “greater confidence” that inflation is on a sustainable downward path before they lower the federal funds rate. According to the statement, there has recently been a “lack of further progress” in getting inflation back down. In short, the economic data this year has indicated that the decline in inflation has stalled, and officials plan to wait and see what happens next before taking action. Most investors now anticipate that the first rate cut will take place in September.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. It will be an extremely light week for economic reports. Weekly Jobless Claims will be released on Thursday and Consumer Sentiment on Friday. Treasury auctions on Wednesday and Thursday also may influence mortgage markets.

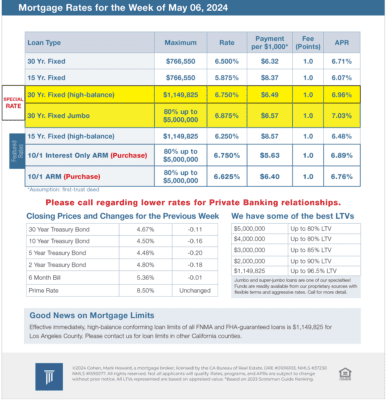

Mortgage Rates for the week of 5-06-2024