Inflation concerns remained the primary focus for investors last week. The latest readings revealed additional increases, and mortgage rates rose to the highest levels since late 2018.

Inflation Hits Another High

The Consumer Price Index (CPI) is a closely watched inflation indicator that looks at price changes for a broad range of goods and services. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term trend. In March, Core CPI was 6.5% higher than a year ago, up from an annual rate of increase of 6.4% last month, and the highest level since 1982.

As the economy has steadily recovered from the pandemic, strong consumer demand, supply constraints, and surging commodity prices have pushed prices much higher for a wide range of goods and services. The conflict in Ukraine and the recent shutdowns in China due to Covid have worsened shortages for many key items. For example, airline fares were 24% higher than a year ago, and used car prices were 35% higher than last

year at this time. Over time, supply chain disruptions will ease, and Fed tightening will reduce inflationary pressures, but it is not clear how quickly this will occur.

Consumer Spending Remains Strong

Since consumer spending accounts for over two-thirds of US economic activity, it is an important indicator of the health of the economy. In March, retail sales matched expectations with an increase of 0.5% from February and were 7% higher than a year ago. Despite rising prices, consumer spending has remained very strong so far this year.

Mortgage Purchase Applications Decrease

Rising mortgage rates have taken a large toll on mortgage application volumes this year. According to the latest data from the Mortgage Bankers Association (MBA), average 30-year fixed rates are more than 1.75% higher than a year ago. Purchase applications are down 6% from last year at this time, while applications to refinance a loan have plunged a shocking 62% from one year ago. The MBA now forecasts that total mortgage originations this year will be 35% lower than last year due to the massive decline in refinancings.

Major Economic News Due This Week

Looking ahead, investors will continue to closely follow news on Ukraine and will look for additional Fed guidance on the pace of future rate hikes and balance sheet reduction. Beyond that, it will be a light week for economic data with a focus on the housing sector. Housing Starts will be released tomorrow and Existing Home Sales on Wednesday. Mortgage markets were closed on last Friday in observance of Good Friday.

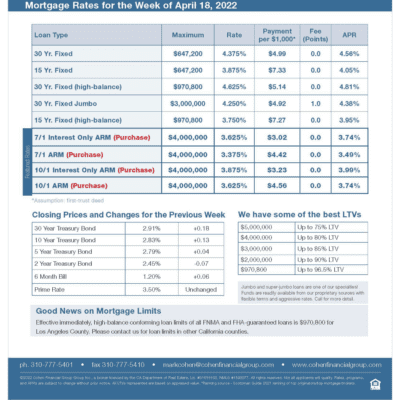

mortgage rates week of 4-18-2022