Inflation Data Raises Bond Market

Higher than expected inflation data was negative for mortgage markets last week. Inflation reduces the value of future cash flows, forcing bond yields to rise to attract investors. As a result, mortgage rates climbed to the highest levels of the year.

Core CPI Above Forecast

The Consumer Price Index (CPI) is one of the most widely followed inflation indicators. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors typically look at core CPI, which excludes the food and energy components. In March, Core CPI rose 0.4% from February, above the consensus forecast, and stands 3.8% higher than a year ago.

Housing Costs Remain Elevated

Although the core CPI annual rate has fallen from a peak of 6.6% in September 2022, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. One big reason is that shelter (housing) costs remained elevated and again were responsible for the largest portion of the increase. However, the CPI data measures shelter costs with a lag, and more timely indicators from other sources suggest that this component will slowly come down later in the year. Other categories with large monthly increases included eating out, medical care, and auto insurance. In fact, auto insurance is now 22% higher than a year ago, the largest annual rate of increase since the 1970s.

PPI Data Points to Fed Rate Cut Delay

Another inflation indicator released last week which measures costs for producers was in line with the consensus forecast, but its annual rate of increase jumped significantly. The core Producer Price Index (PPI) was 2.4% higher than a year ago, up from an annual rate of 2.0% last month. Due to the inflation data this week, expectations for a reduction in the US federal funds rate have been pushed out until even later in the year. Investors now anticipate that the first rate cut by the Fed will not take place until September. By contrast, investors still indicate that the European Central Bank is on track to begin cutting rates in June.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, Retail Sales will come out on Monday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Housing Starts will be released on Tuesday and Existing Home Sales on Thursday.

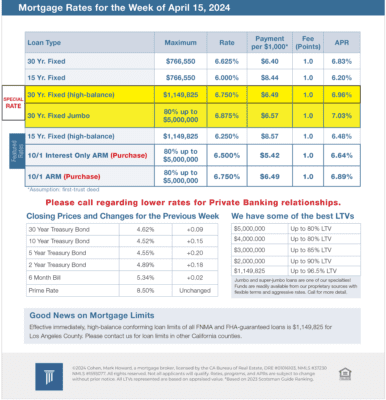

Mortgage Rates for the week of 4-15-2024