Negative Mortgage Markets Pushes Rates Up

Stronger than expected data caused investors to raise their outlook for economic growth last week, which was negative for mortgage markets. In particular, job growth continued to exceed the forecasts of economists. As a result, mortgage rates climbed to the highest levels of the year.

New Jobs Favoring Part-time over Full-time

Following strong gains for the last three months, the economy added another massive 303,000 jobs in March, well above the consensus forecast of 200,000. The greatest gains were seen in the healthcare, government, and restaurant/hospitality sectors. Interestingly, the report indicated that most new jobs this month were part-time rather than full-time, with many people adding second jobs.

Fed Monitoring Wage Growth

The other major components of the report were in line with expectations. The unemployment rate fell from 3.9% to 3.8%, but still is up from 3.4% in April 2023, which was the lowest level since 1953. Average hourly earnings were 4.1% higher than a year ago, down from 4.3% last month, and stand at the lowest annual rate of increase since June 2021. Fed officials carefully monitor wage growth because it generally raises future inflationary pressures.

Manufacturing Sector Improves

Two other significant economic reports released last week from the Institute of Supply Management revealed some interesting results. The ISM national services sector index fell to 51.4, while the national manufacturing index rose to 50.3. Readings above 50 indicate an expansion in the sector and below 50 a contraction. This was the narrowest gap between the two reports in years, suggesting that the consumer preference for services over goods since the end of the pandemic lockdowns is finally moderating. Also notable, this was the first reading above 50 for the manufacturing sector after sixteen straight months below that level, the longest streak in about 15 years.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, by far the most important will be the Consumer Price Index (CPI) on Wednesday. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. The detailed minutes from the March 15 Fed meeting also will come out on Wednesday. Import Prices will be released on Friday.

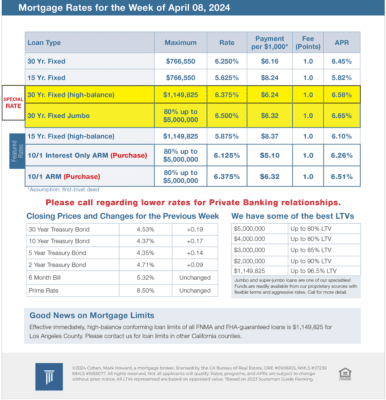

Mortgage Rates for the week of 4-08-2024