Quiet and Short Week for Mortgage Markets

There was little significant economic news during this short holiday week last week. The biggest economic report of last week, PCE inflation, was released on Friday, but mortgage markets were closed so any reaction will be seen on Monday. Mortgage rates ended the quiet week last week nearly unchanged.

Builders Offer Incentives for New Homes

Sales of newly built homes, which currently account for about 15% of the total market, tend to be volatile from month to month. In February, new home sales fell slightly from January, but still were 6% higher than a year ago. The median new-home price of $400,500 was 8% lower than last year at this time, and builders continue to offer financial incentives to encourage buyers.

Inflation Remains the Focus

With inflation in focus, the monthly report on consumer confidence published by the Conference Board has been receiving more attention lately, since it may provide hints about upcoming changes in spending habits. In the most recent reading, it unexpectedly fell to the lowest level since November. Concern about the political environment was the most common reason cited for the decline in confidence this month. Investors will be keeping a close eye on upcoming Retail Sales reports to see if this weakness translates into lower consumer spending.

Labor Markets Remains Strong

The Department of Labor releases the total number of new claims for unemployment insurance each week, and the most recent reading was just 210,000. This was down sharply from the inflated figures seen during the early months of the pandemic and even lower than the levels which were typical during 2019. Sustained strength in the labor market is one reason that Fed officials are in no hurry to begin lowering the federal funds rate.

Major Economic News Due This Week

Mortgage markets will be closed on Friday in observance of Good Friday, but Personal Income and the PCE price index, the inflation indicator favored by the Fed, still will be released that day. The ISM national manufacturing index will come out on Monday and the national services sector index on Wednesday. The key Employment report will be released on April 5, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month.

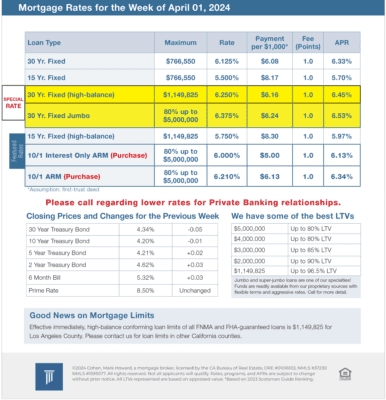

Mortgage Rates for the week of 4-01-2024