Mortgage Rates Lowered Last Week

Smaller than expected wage increases and a reduced outlook for global economic growth due to troubles in the banking sector were favorable for mortgage markets last week. As a result, mortgage rates moved lower.

Unemployement Rates Rose

The latest Employment report contained mixed news. After the economy added a stunning 517,000 jobs in January, the consensus forecast for February was for a more moderate 225,000, and this was exceeded with gains of 311,000. The gains were broad based with particular strength seen in leisure, hospitality, professional services, and retail. The unemployment rate unexpectedly rose to 3.6% from 3.4%, which was the lowest level since 1969.

Average hourly earnings, an indicator of wage growth, were 4.6% higher than a year ago, high by historical standards, but below the consensus forecast for an annual rate of 4.8%. A major concern for Fed officials is that low unemployment will lead to larger and larger wage increases as companies compete for workers, causing greater inflationary pressures.

Job Openings Reflect Strong Labor Market

The JOLTS report measures job openings and labor turnover rates, and the latest data also indicated that the labor market remains very tight. At the end of January, there were an enormous 10.8 million job openings, above the consensus forecast and over 4 million more than in January 2020 prior to the pandemic. There were 1.9 job openings for every unemployed worker, up from typical readings around 1.2 before the pandemic. A high level of openings reflects a strong labor market, as companies struggle to hire enough workers with the necessary skills.

Fed Warns Rate Hike May Rise 50 Basis Points

In semi-annual testimony to Congress last week, Fed Chair Powell maintained a very aggressive stance on fighting inflation. He emphasized that the federal funds rate may need to increase even higher than anticipated and remain there for a longer period of time to bring down inflation. He warned that future rate hikes could be 50 basis points rather than just 25 depending on the strength of incoming economic data. Given the mixed message from the relatively good news on wages and the continued strong job gains, investors are divided about the size of the rate hike at the next Fed meeting on March 22. The highly anticipated CPI inflation report this week may be the deciding factor.

Major Economic News Due This Week

Investors will be closely watching to see if Fed officials elaborate on their plans for future rate hikes. The most anticipated economic report of the week, the Consumer Price Index (CPI), will be released on Tuesday. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Retail Sales will come out on Wednesday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Housing Starts and Import Prices will come out on Thursday. The next European Central Bank meeting also will take place on Thursday.

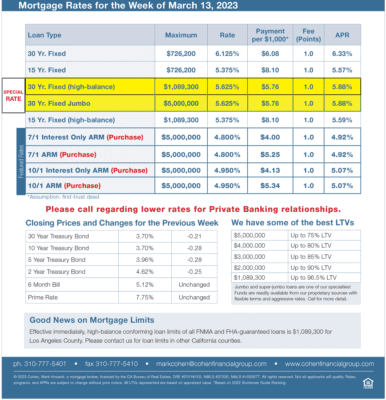

Mortgage Rates for the week of 3-13-2023