Weak Economic Data

This last week, the major economic data was weaker than expected, and there were no unfavorable surprises from the Fed. As a result, mortgage rates ended a little lower.

Strong Gains in Employment

Following very strong gains in January, the economy added another 275,000 jobs in February, well above the consensus forecast of 200,000. The largest gains were seen in the healthcare, government, and restaurant/hospitality sectors. However, the results for prior months were revised lower by a massive 167,000, more than offsetting the strength this month.

Hourly Earnings Below Consensus

The other major components of the report also revealed unexpected weakness. The unemployment rate rose to 3.9%, the highest reading since January 2022. This is up from 3.4% in April 2023, which was the lowest level since 1953. Average hourly earnings were 4.3% higher than a year ago, below the consensus forecast. Fed officials carefully monitor wage growth because it generally raises future inflationary pressures.

Another major economic report released last week also fell short of expectations. Since services account for roughly 75% of economic activity in the US, investors closely watch key data on the sector from the Institute of Supply Management. The latest report revealed that the ISM national services index fell to 52.6, below the consensus forecast. Still, readings above 50 indicate an expansion in the sector.

Fed Monetary Policy Unchanged

In his semi-annual testimony to Congress, Fed Chair Powell stuck to the same script as in other recent speeches. He continued to emphasize that incoming economic data would determine future decisions on monetary policy and that officials would carefully consider the risks of waiting too long to cut rates versus loosening too soon. Most investors now anticipate that the first rate cut will take place in June.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy ahead of the next meeting on March 20. For economic reports, the Consumer Price Index (CPI) will be released on Tuesday. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Retail Sales will come out on Thursday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Import Prices will be released on Friday.

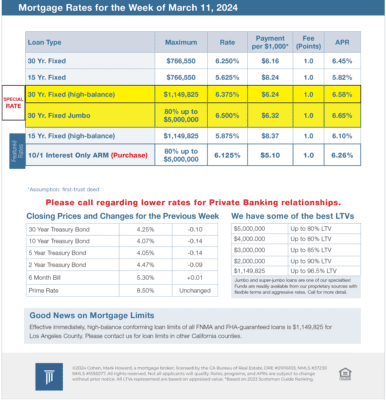

Mortgage Rates for the week of 3-11-2024