Mortgage Rates Lower

There was plenty of major economic news last week, but few surprises. The Fed meeting had little impact on mortgage markets, and the latest inflation data matched expectations. Mortgage rates ended last week a bit lower.

PCE Price Index

Fed officials keep a close eye on inflation, and the PCE price index is their favored indicator. In December, Core PCE rose 0.2% from November, matching expectations. Core PCE was 2.8% higher than a year ago, the same annual rate of increase as last month. While far below its recent peak, further progress toward the 2.0% target of the Fed remains challenging, and this desired level has not been achieved since February 2021.

Economic Activity

Gross Domestic Product (GDP) is the broadest measure of economic activity. During the fourth quarter of 2024, U.S. GDP rose at an annualized rate of 2.3%, below the consensus forecast of 2.6% and down from 3.1% during the third quarter. Consumer spending and government spending were two of the biggest contributors to the growth during the quarter, while a decline in inventories subtracted substantially from it. In addition, business investment dropped for the first time in more than three years.

Federal Funds Rate

As expected, the Fed made no change in the federal funds rate last Wednesday, and the statement released after the meeting was very similar to the prior one. Investors did initially focus on one alteration which removed a reference to inflation making progress toward the target level of 2.0%. However, during the press conference following the meeting, Chair Powell reassured investors that this change in language was not intended to convey any new information. Beyond this, Powell responded to questions about the impact of potential policy changes under the new administration by saying that the level of uncertainty has increased in the short-term, but future decisions will continue to be based on incoming economic data.

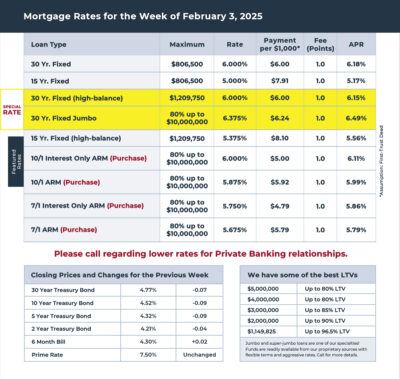

Mortgage Rates for the week of 2-3-2025