No Surprises from the Fed

With a lack of major economic news, it was a quiet week for mortgage markets last week. The most significant data came from the housing sector and caused little reaction. Similarly, the Fed minutes contained no surprises and had a minor impact. Mortgage rates ended last week nearly unchanged.

Inventory Levels Remain Low

Sales of existing homes in January rose modestly from December but still were 2% lower than last year at this time. Inventory levels remain stuck near historic lows, standing at just a 3.0-month supply nationally, far below the 6-month supply typical in a balanced market. The median existing-home price of $379,100 was 5% higher than last year at this time.

Housing Starts Fall – Outlook Positive for Future Construction

Additional inventory of homes continues to be badly needed in many areas, but the latest data was mixed. In January, single-family housing starts fell 5% from December. By contrast, single-family building permits, a leading indicator of future construction, rose slightly to the best level since May 2022. In addition, a separate survey of home builder sentiment on housing market conditions from the NAHB unexpectedly jumped from 44 to 48.

Fed In No Hurry to Cut Interest Rates

The minutes from the January 31 Fed meeting released on last Wednesday revealed no significant new information beyond what officials have said in recent speeches. The consistent message continues to be that they are in no hurry to cut interest rates. Officials generally feel that the risks of maintaining tighter policy for too long and loosening it too soon are roughly balanced, so they prefer to wait for “greater confidence” that inflation will continue on a path down to their target level of 2.0%. At the beginning of the year, most investors anticipated that the first rate cut would be seen at the next Fed meeting on March 20, but the consensus now is that it will not take place until June.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, New Home Sales will be released on Monday. Personal Income and the PCE price index, the inflation indicator favored by the Fed, will come out on Thursday. The ISM national manufacturing index will come out on Friday. The key Employment report will be released on March 8.

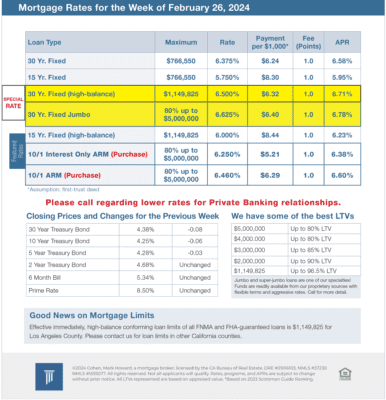

Mortgage Rates for the week of 2-26-2024