Mixed Data

The major economic data released last week sent a mixed message. On the one hand, inflation was significantly higher than expected. On the other hand, consumer spending fizzled out in January. Overall, investors placed more weight on the inflation data, and mortgage rates ended the week higher.

Core CPI Slightly Higher

The Consumer Price Index (CPI) is one of the most widely followed inflation indicators. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors typically look at core CPI, which excludes the food and energy components. In January, Core CPI rose 0.4% from December, above the consensus forecast and 3.9% higher than a year ago.

Shelter Costs Remain Elevated

Although the core CPI annual rate has fallen from a peak of 6.6% in September 2022, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. One big reason is that shelter (housing) costs remained elevated and again were responsible for the largest portion of the increase. However, the CPI data measures shelter costs with a lag, and more timely indicators from other sources suggest that this component will slowly come down later in the year. Other categories with large monthly increases included airline fares, food, and auto insurance.

Core PPI Higher Than Expected

Adding to the inflation concerns, another indicator released last week which measures costs for producers also was much higher than expected. The core Producer Price Index (PPI) jumped 0.5% from December, far above the consensus forecast of just 0.1%.

Outlook for Fed Rate Cut Pushed

Due to the higher than expected inflation data, expectations for a reduction in the federal funds rate have been pushed out until later in the year. While some investors not long ago were saying that the first rate cut would be seen at the next Fed meeting in March, most now anticipate that it will not take place until June.

Consumer Spending Remains Strong

Despite higher prices and credit card rates, consumer spending remained surprisingly strong in 2023 and was one of the primary pillars supporting economic growth. In January, however, retail sales plunged 0.8% from December, far below the consensus forecast for a decline of just 0.2% and the largest monthly loss since March 2023. The results for prior months were revised lower as well.

Weather Conditions Cause Decline in Consumer Spending

Some of the decline in consumer spending can be attributed to unusually severe winter weather in many parts of the country. Most notably, building materials and garden equipment dropped 4.1% from December. Weather does not fully explain the unexpected weakness in January in several other areas, however, such as electronics, appliances, clothing, and motor vehicle parts.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. It will be an extremely light week for economic reports. Existing Home Sales will be released on Thursday. The minutes from the January 31 Fed meeting will come out on Wednesday. Mortgage markets will be closed on Monday for Presidents Day.

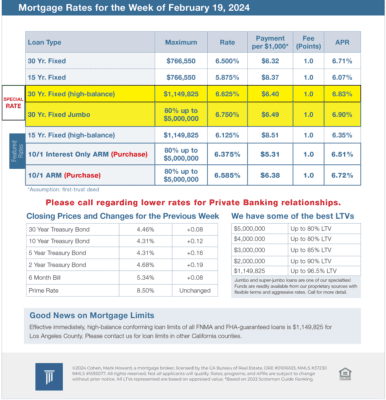

Mortgage Rates for the week of 2-19-2024