Strong Economic Report Triggers Rise in Mortgage Rates

With little significant economic news, it was a quiet week for mortgage markets. The one major economic report released last week was stronger than expected and nudged mortgage rates a bit higher.

Expansion in the Service Sector

Since services account for roughly 75% of economic activity in the US, investors closely watch a key report on the sector from the Institute of Supply Management. The latest data revealed that the ISM national services index rose to 53.4, above the consensus forecast and the highest level since August. Readings above 50 indicate an expansion in the sector.

Tight Labor Market

The Department of Labor releases the total number of new claims for unemployment insurance each week, and the latest reading was just 217,000. This was down sharply from the inflated figures seen during the early months of the pandemic and a little lower than the levels which were typical during 2019. Given the tightness of the labor market in recent years, this report reflects the reluctance of companies to let workers go.

Strong Labor Market Data Changes Outlook for Rate Cut

One notable consequence of the stronger than expected labor market data week before last week and the services sector report last week is that expectations for a reduction in the federal funds rate have been pushed out until later in the year. While some investors not long ago were saying that the first rate cut would be seen at the next Fed meeting in March, nearly all now anticipate that it will not take place until May or June.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, the Consumer Price Index (CPI) will be released on Tuesday. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Retail Sales will come out on Thursday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Housing Starts will be released on Friday.

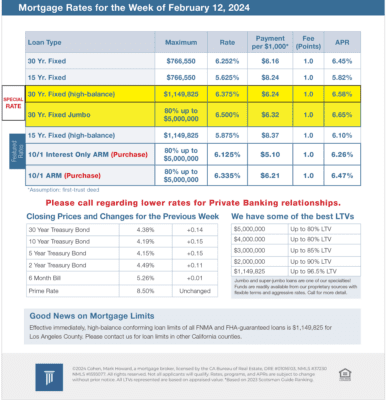

Mortgage Rates for the week of 2-12-2024