Inflation Moderates

With little significant economic news, mortgage markets were relatively quiet last week. The major inflation data was a bit weaker than expected, but its impact was minor, and rates ended last week nearly unchanged.

Inflation Numbers Moving in the Right Direction

The PCE price index is the inflation indicator favored by the Fed. In November, core PCE, which excludes food and energy to reduce short-term volatility, was up 3.2% from a year ago, a little below the consensus forecast. This was down from an annual rate of 3.4% last month and the lowest level since March 2021. While still moving in the right direction, it remains above the Fed’s target of 2.0%.

Inventory Levels Stuck

After falling to the slowest pace since 2010 last month, sales of existing homes in November rose a little from October but still were 7% lower than last year at this time. Inventory levels remain stuck near historic lows, standing at just a 3.5-month supply nationally, far below the 6-month supply typical in a balanced market. The median existing-home price of $387,600 was 4% higher than last year at this time. Since average mortgage rates in December have been significantly lower than in November, sales activity is likely to show greater improvement in the next report.

Encouraging Data on Housing Starts

Additional inventory of homes continues to be badly needed in many areas, and the latest data was encouraging. In November, single-family housing starts increased 18% from October to the highest level since April 2022 and were 42% higher than a year ago. Single-family building permits, a leading indicator of future construction, rose to the best level since May 2022. In addition, a separate survey of home builder sentiment on housing market conditions from the NAHB jumped from 34 to 37, snapping a four-month decline.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. No major economic reports will be released during the final week of the year. The ISM national manufacturing index will come out on January 3 and the national services index on January 5. The key Employment report also will be released on January 5, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month. Mortgage markets will close early on December 22 and December 29.

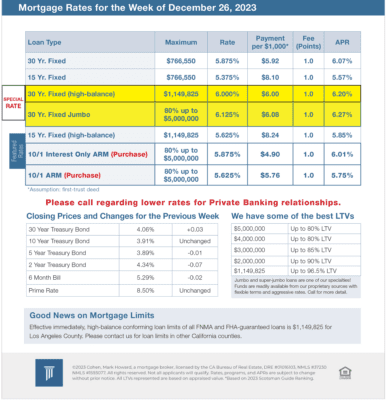

Mortgage Rates for the week of 12-26-2023