Quiet Week – Service Sector Gains

With little major economic news last week, and several key events on tap for this week, mortgage markets were relatively quiet. As usual, trading volume has been declining as we approach the end of the year. Mortgage rates ended last week slightly higher.

Shift From Goods to Service

The most significant economic report released last week revealed unexpected strength in service industries in November. The ISM national services index rose to 56.5, far above the consensus forecast. Levels above 50 indicate that the sector is expanding. These results contrasted with the ISM manufacturing sector data released last week which dropped to the lowest level since May 2020. After a big swing toward goods during the pandemic, consumer spending has been shifting back to services this year.

PPI Inflation Indicators

The Producer Price Index (PPI) measures the change in selling prices received by domestic producers, meaning wholesale prices for items used to make finished products. In November, PPI rose 0.3% from October, above the consensus forecast. It was 7.4% higher than a year ago, though down from 8.0% last month and a peak of 11.7% in March. In short, PPI inflation is moving in the right direction, but the annual rate did not decline as much as expected. Investors place much more weight on the broader Consumer Price Index (CPI) data which will be released this week.

High Mortgage Rates – Low Application Volume

Despite dropping over the last few weeks, higher mortgage rates continue to heavily impact mortgage application volumes, which remain near the lowest levels in 25 years. According to the latest data from the Mortgage Bankers Association (MBA), purchase applications are down 40% from last year at this time, and applications to refinance a loan have plunged a shocking 86% from one year ago. The average loan size for homebuyer applications fell to $387,300, the lowest level since January 2021.

Major Economic News Due This Week

The final three major economic events of the year will take place next week. The biggest economic report will be the CPI inflation data on Tuesday. The Consumer Price Index (CPI) is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. The next Fed meeting will take place on Wednesday. A 50 basis point rate hike is expected, and investors will be looking for more specific guidance on the pace of future rate hikes and bond portfolio reduction. Finally, the next European Central Bank meeting will follow on Thursday, and a 50 basis point rate increase is also expected.

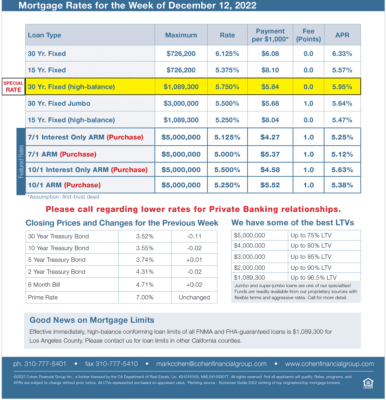

Mortgage Rates for the week of 12-12-2022