Looser Monetary Policy Favors Mortgage Markets

While the major economic data released last week caused little reaction, surprisingly dovish (in favor of looser monetary policy) comments from a Fed official were favorable for mortgage markets. As a result, rates ended the week lower.

Fed Confident in Goals to Bring Down Inflation

Prior to last week, Fed officials carefully avoided providing any precise guidance on the conditions or the timing of a cut in the federal funds rate. They focused instead on whether monetary policy was tight enough to bring down inflation or whether additional rate hikes would be needed. In a speech on last Tuesday, however, the Fed’s Christopher Waller unexpectedly deviated from this script by hinting that the Fed may be finished with rate hikes and laying out his conditions for lowering rates. He said that he is “increasingly confident” that monetary policy already is sufficiently tight to achieve their goals in bringing down inflation. In addition, he thought that it would be reasonable to see the Fed begin cutting rates if inflation continues to slow over the next three to five months, but he said that it is still “too early” to predict how likely this is to occur. Notably, rather than following his lead, officials (including Chair Powell) speaking later in the week generally shifted the discussion back to whether additional tightening will be needed. After weighing these comments, investors now anticipate that there will be multiple rate cuts next year, with the first likely taking place in May.

Manufacturing Sector Continues to Struggle

The PCE price index is the inflation indicator favored by the Fed. In October, core PCE, which excludes food and energy to reduce short-term volatility, was up 3.5% from a year ago, matching the consensus forecast. This was down from an annual rate of 3.7% last month and the lowest level since May 2021. While still moving in the right direction, it remains far above the Fed’s target of 2.0%.

Another significant economic report released this week from the Institute of Supply Management again reflected the prolonged struggles for the manufacturing sector this year. The ISM national manufacturing index was just 46.7, close to the lowest level since May 2020. Readings above 50 indicate an expansion in the sector and below 50 a contraction. This was the thirteenth straight month of readings below 50 for the manufacturing sector, the longest streak in about 15 years.

New Loan Limits Announced for 2024

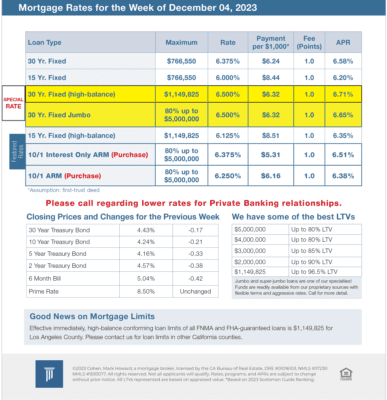

In other news, the Federal Housing Finance Agency (FHFA) announced that the baseline conforming loan limit for Fannie Mae and Freddie Mac mortgages in 2024 will increase 5.5% from $726,200 to $766,550. The new limit for most high-cost areas will be $1,149,825 or 150% of $766,550. This will be the eighth consecutive year of increases.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, the ISM national services index will come out on Monday. The JOLTS report, measuring job openings and labor turnover rates, will come out on Tuesday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month.

Mortgage Rates for the week of 12-04-2023