Employment Data Pushes Rates Lower

With the end of the shutdown, the flow of key government economic data has gradually resumed, beginning with the delayed Employment report for September. This labor market data was mixed, and the reaction was slightly positive for mortgage markets. As a result, rates ended last week a little lower.

Job Gains but Rising Unemployment

The Employment report revealed that the economy added 119,000 jobs in September, above the consensus forecast of 50,000. Strength was seen in health care, leisure/hospitality, and social assistance. However, the unemployment rate unexpectedly increased from 4.3% to 4.4%, the highest level since October 2021. Average hourly earnings were 3.8% higher than a year ago, up from an annual rate of 3.7% last month.

Next Jobs Report Timing Matters

Of note, the release date for the next Employment report is scheduled for December 16, after the Fed meeting on December 10. Recent comments from Fed officials about future monetary policy have varied greatly, and investors remain nearly evenly split about whether the Fed will reduce the federal funds rate by another 25 basis points at this meeting.

Builder Sentiment Improves Slightly

The latest survey of home builder sentiment on housing market conditions from the NAHB unexpectedly rose from 37 to 38, the highest level since April. However, the index remained in negative territory below 50 for the nineteenth straight month. According to the NAHB, 41% of builders reported cutting prices as an incentive to attract buyers, the highest level since the pandemic. Builders said that uncertainty about tariffs and rising costs made it more difficult to price their homes.

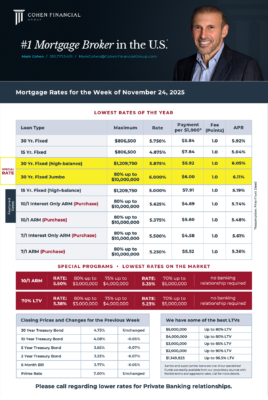

Mortgage Rates for the week of 11-24-2025