Mortgage Rates Remain Stable

The investor outlook for inflation, economic growth, and future Fed policy remained relatively stable last week. As a result, mortgage rates ended nearly unchanged.

Home Sales

Hurt by higher mortgage rates, sales of existing homes fell for the ninth straight month in October to the lowest level since 2011 and were 28% lower than last year at this time. Inventory levels were slightly lower than a year ago, at just a 3.3-month supply nationally. While the median existing-home price of $379,100 was 7% higher than a year ago, this was down from a record high of $413,800 in June.

Low New Construction Continues to Disappoint

A lack of inventory of homes for sale has been a lingering issue, yet the pace of new construction continues to be disappointing. In October, overall housing starts fell 4% from September and were 9% lower than a year ago. Single-family starts were down a much larger 22% from a year ago to the lowest level since May 2020, early in the pandemic. A survey of home builder sentiment from the NAHB declined for the eleventh straight month to 33, less than half what it was just six months ago, and the lowest reading since 2012. A level below 50 is considered negative. Higher prices and shortages for land, materials, and skilled labor remained major issues holding back builders.

Consumer Spending Remains Strong

Consumer spending accounts for over two-thirds of US economic activity, making it an important indicator of the health of the economy. In October, retail sales surged 1.3% from September, above the consensus forecast, and a strong 8.3% higher than a year ago. While some of this increase was simply due to higher prices, especially large gains were seen in spending at bars and restaurants, furniture stores, and auto dealers. This report helped ease investor concerns about a slowdown in shopping due to higher prices heading into the crucial holiday season.

Fed Remains Committed To Fighting Inflation

Fed officials last week emphasized that they need to continue to aggressively fight inflation, which remains far above their stated target level of 2.0%. In particular, James Bullard said that the tightening already done has had only “limited effects” in achieving this goal and that the federal funds rate must be raised further to be “sufficiently restrictive.” He described one method of analysis which suggests that the peak for the federal funds rate will need to be between 5.0% and 7.0%. Investors currently anticipate that this terminal rate will be around 5.0%, so his potential range was a surprise for many. However, other Fed officials may not share his outlook, and his comments had little lasting impact on financial markets.

Major Economic News Due This Week

Investors will be hoping for more specific Fed guidance on the pace of future rate hikes and bond portfolio reduction. New Home Sales will be released on Wednesday. The core PCE price index, the inflation indicator favored by the Fed, will come out on December 1. The key Employment report will be released on December 2nd. Mortgage markets will be closed on Thursday and will close early on Friday in observance of Thanksgiving.

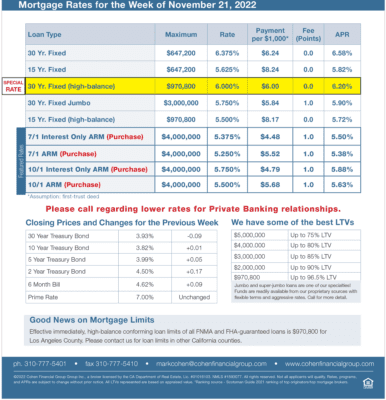

Mortgage Rates for the week of 11-21-2022