Rates Hold Steady After Shutdown

Mortgage markets were relatively quiet over the past week. No major economic data was released, and the end of the government shutdown caused little reaction. As a result, mortgage rates ended last week nearly unchanged.

Shutdown Ends, Data Delays Persist

After a record 43 days, the government shutdown ended on Wednesday. With the exception of one Consumer Price Index inflation report, no government economic data was released during this period. It is expected that government agencies will soon announce the schedule for delayed reports based on how quickly data collection can catch up. A White House official said that missed key labor market and inflation reports for October may never come out. In addition, there may be questions about the accuracy of some of the data for a couple of months.

Fed Faces Tough Policy Crossroads

As difficult as the data blackout period has been for investors, Fed officials have struggled under even more pressure to navigate during the past six weeks. As Chair Powell made clear at the last Fed meeting, officials are divided about how to proceed. Signs of weakness in the labor market support additional loosening of monetary policy, but stubbornly elevated inflation levels since tariffs increased favor holding steady. Attempting to prioritize these conflicting goals is difficult under any circumstances, but doing it while flying blind with extremely limited economic data is extremely challenging, to say the least. As a result, investors are nearly evenly split about whether the Fed will reduce the federal funds rate by another 25 basis points at the next meeting in December.

Retail Hiring Signals Weak Demand

Investors continue to look for alternative information from private companies. One report receiving attention last week revealed disappointing news about the labor market and the important holiday shopping season. According to Indeed Hiring Lab, retail-related job postings declined 16% in October from last year at this time. This typically reflects the consumer demand anticipated by retailers, which may be depressed this year due to the impact of higher tariffs and the government shutdown. According to several large retailers, another factor behind the reduced hiring needs is that fewer employees are voluntarily quitting their jobs, likely due to greater uncertainty about their prospects for finding better opportunities at another company.

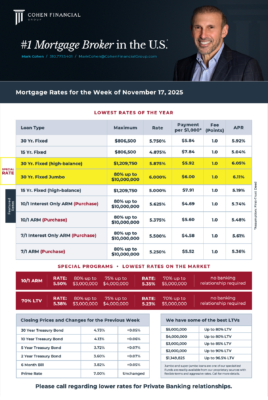

Mortgage Rates for the week of 11-17-2025