Downside Inflation Surprise

While the election results had little impact on mortgage markets last week, the CPI report on last Thursday caused an enormous reaction. It revealed that inflation was lower than expected, and mortgage rates declined substantially.

CPI Index Below Consensus Forcast

The Consumer Price Index (CPI) is a closely watched inflation indicator that looks at price changes for a broad range of goods and services. In October, CPI was 7.7% higher than a year ago, far below the consensus forecast of 8.0%. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term inflation trend. Core CPI in October was up 6.3% from a year ago, also well below the consensus forecast, and down from 6.6% last month, which was the highest annual rate since 1982.

Helping the figures come in below the expected levels, used car prices dropped 2.4% in October. Apparel and medical care services also posted steep monthly declines. Shelter (housing) costs, which account for roughly one-third of the CPI index, continued to post significant gains in October, but this component generally operates with a lag. Current indicators of shelter costs such as newly signed rental agreements suggest that this area will provide downward pressure on overall inflation readings in coming months.

Inflationary Pressures

Inflation remains far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. To help reduce inflationary pressures and reach this goal, the Fed will continue to raise the federal funds rate at future meetings. However, the magnitude of additional rate hikes anticipated by investors dropped sharply due to the CPI data. For example, investors were nearly evenly split before the report between a 50 and a 75 basis point increase at the next meeting in December and now widely expect just 50 basis points.

Major Economic News Due This Week

Investors will be hoping for more specific Fed guidance on the pace of future rate hikes and bond portfolio reduction. Retail Sales will be released on Wednesday. Since consumer spending accounts for over two-thirds of U.S. economic activity, the retail sales data is a key measure of the health of the economy. Import Prices also will come out on Wednesday. Housing Starts will be released on Thursday and Existing Home Sales on Friday.

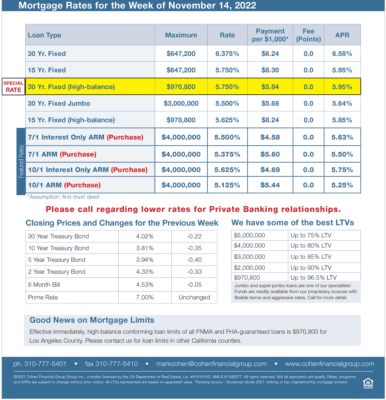

Mortgage Rates for the week of 11-14-2022