Bond Yields Rise

There were two major economic events on tap last week, but only one produced much reaction. The Fed meeting on last Wednesday caused investors to raise their outlook for monetary policy tightening, pushing bond yields higher, while the highly anticipated labor market data released on Friday was close to expectations overall and had little impact. As a result, mortgage rates ended the week higher.

Fed Remains Committed To Curbing Inflation

As expected, the Fed raised the federal funds rate by another 75 basis points on last Wednesday to a target range of 3.75% to 4.00%, the highest level since January 2008. Investors initially were encouraged because the meeting statement noted that the pace of future increases will take into account the long lag in the effects of monetary policy on economic activity, suggesting that the magnitude of future hikes may be smaller. However, Chair Powell later rained on the parade during his press conference by saying that the peak federal funds rate needed to get inflation under control may be higher than currently anticipated. In other words, the pace of rate hikes may slow, but the total increase may be large r before the Fed is done. Significantly raising their outlook, investors now expect that the federal funds rate will exceed 5.0% early in 2023 and will remain there for most of the year.

Jobs Report

Against a consensus forecast of 205,000, the economy gained 261,000 jobs in October, the smallest monthly increase since December 2020. The best performing sectors were leisure, hospitality, professional services, and health care. The unemployment rate rose more than expected to 3.7% from 3.5%, which was the lowest level in decades. Average hourly earnings, an indicator of wage growth, were 4.7% higher than a year ago, down from an annual rate of 5.0% last month.

Low ISM Reports

Two other significant economic reports released this week from the Institute of Supply Management (ISM) hinted at slower economic growth. The ISM national services sector index fell to 54.4 and the ISM national manufacturing index dropped to 50.2. Both readings were the lowest since May 2020, but levels above 50 indicate that the sectors are still expanding.

Major Economic News Due This Week

Investors will be hoping for more specific Fed guidance on the pace of future rate hikes and bond portfolio reduction. The biggest economic report will be the CPI inflation data on Thursday. The Consumer Price Index (CPI) is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services. Beyond that, any major surprises in the election results on Tuesday could influence mortgage rates. Mortgage markets will be closed on Friday in observance of Veterans Day.

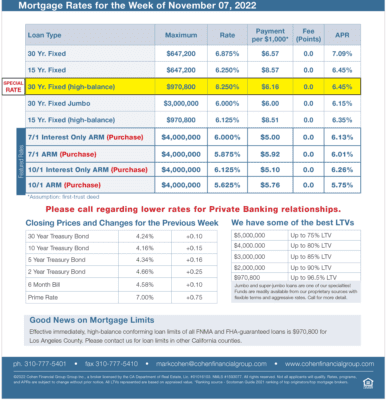

Mortgage Rates for the week of 11-07-2022