Less Aggressive Monetary Policy

Last week, investors scaled back their outlook to a slightly less aggressive pace of monetary policy tightening by global central bankers to fight inflation. As a result, mortgage rates ended the week lower.

Rising PCE and GDP

The PCE price index is the inflation indicator favored by the Fed because it adjusts for changes in consumer preferences over time. In September, core PCE was up 5.1% from a year ago, matching expectations, and down from a peak of 5.4% in February. However, this remains far above the Fed’s target level of 2.0%. This is particularly relevant because how quickly aggressive monetary policy tightening will bring down inflation is a widely debated question with enormous implications for financial markets.

Gross Domestic Product (GDP) is the broadest measure of economic activity. During the third quarter, GDP rose at an annualized rate of 2.6%, above the consensus forecast for an increase of 2.3%, and an improvement from a decline of 0.6% during the second quarter. Particular strength was seen in trade and consumer spending, while residential investment (housing) remained a source of weakness.

European Central Bank Raises Interest Rates

On last Thursday, the European Central Bank (ECB) raised benchmark interest rates by the widely expected 75 basis points to the highest level since 2009 to help bring down inflation. Investors were more uncertain what the guidance would be for the bond purchase program. Unlike the US Fed, the ECB has not yet begun to reduce the size of its bond portfolio, and some investors thought that the ECB would announce a start date. However, officials decided to wait until the next meeting in December to discuss the conditions for further tightening monetary policy by shrinking the bond portfolio. This delay in a reduction in the demand for bonds was favorable for global yields, including US mortgage rates.

Major Economic News Due This Week

The next Fed meeting will take place on Wednesday. While another 75 basis point rate increase is expected, investors are hoping for more specific guidance on the pace of future rate hikes and bond portfolio reduction. The ISM national manufacturing sector index will come out on Tuesday and the ISM national services sector index on Thursday. The key Employment report will be released on Friday, and these figures on the number of jobs, the unemployment rate, and wage inflation will be some of the most highly anticipated economic data of the month.

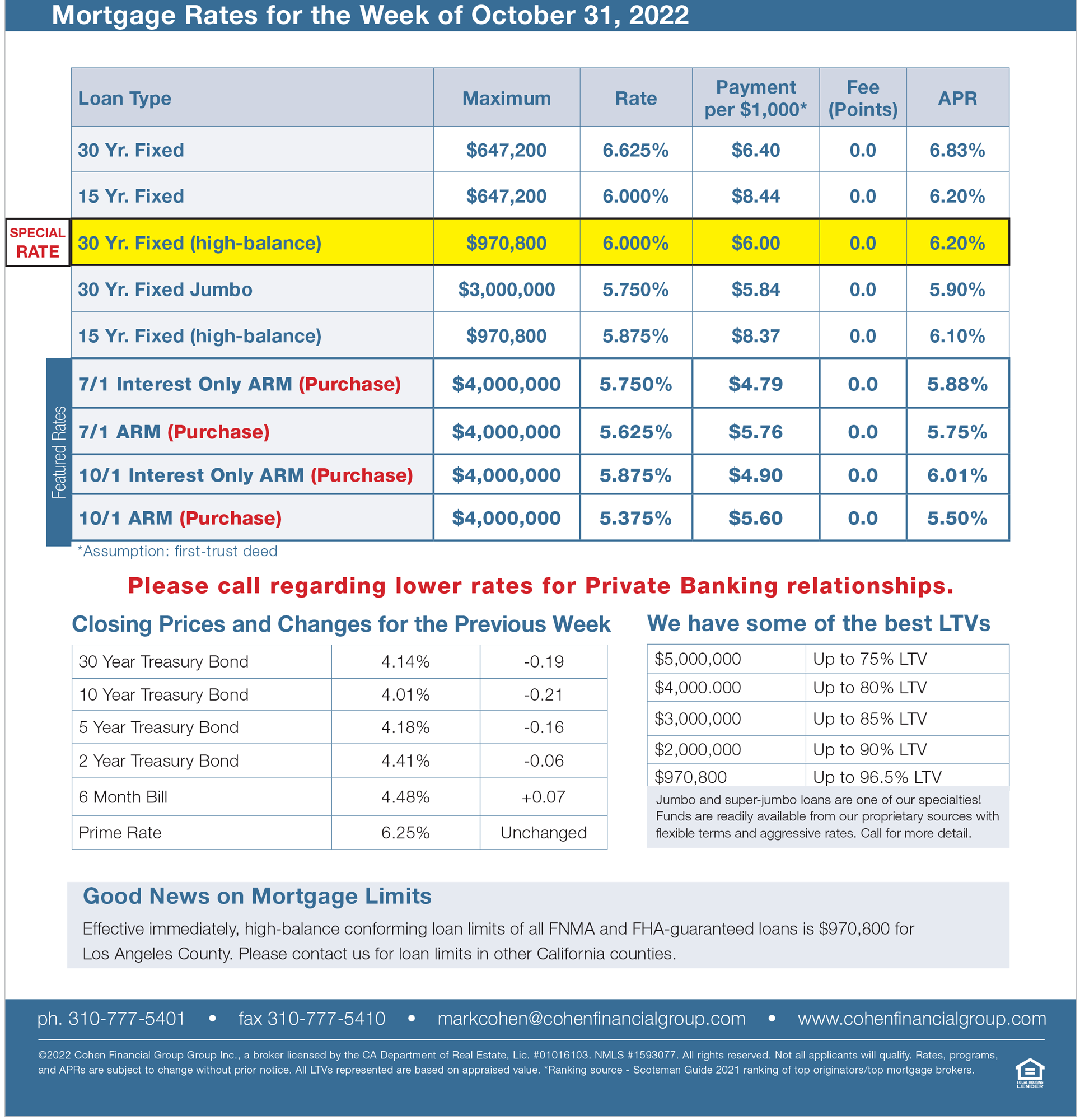

Mortgage Rates for the week of 10-31-2022