Mortgage Rates Hold Steady

With the government releasing the key CPI inflation report last Friday despite the shutdown, there was little activity in mortgage markets last week. The inflation figures were a little lower than expected, but the reaction was limited. As a result, mortgage rates ended last week nearly unchanged, remaining near their lowest levels of the year.

Core CPI Inflation Eases Slightly

The Consumer Price Index (CPI) is one of the most closely watched inflation indicators released each month. To reduce short-term volatility and get a better sense of the underlying inflation trend, investors look at core CPI, which excludes food and energy. In September, Core CPI rose just 0.2% from August, below the consensus for an increase of 0.3%. It was 3.0% higher than a year ago, down from 3.1% last month.

Inflation Still Above Fed’s Target

Although this annual rate has dropped sharply from a peak of 6.6% in September 2022, and from 3.9% in January of last year, it is still far above the readings around 2.0% seen early in 2021, which is the stated target level of the Fed. Shelter (housing) costs continue to be a primary reason why progress on bringing down inflation remains challenging. Originally scheduled for October 15, the Bureau of Labor Statistics released this key report because it is used to calculate Social Security cost-of-living benefit adjustments. No other government data will be released during the shutdown.

Existing Home Sales Reach Highs

In September, sales of existing homes rose 2% from August, close to expectations, to the highest level in seven months. The median price of $415,200 was up a slim 2% from last year at this time but was 53% higher than prior to the pandemic. Inventories remain stuck at low levels, standing at just a 4.6-month supply nationally, below the roughly 6-month supply typical in a balanced market. However, inventories were 14% higher than a year ago. According to the chief economist of the National Association of Realtors (NAR), “improving” housing affordability mostly due to lower rates is contributing to increasing sales, and first-time homebuyers made up 30% of sales in September, up from 26% last year at this time.

Lower Rates Boost Mortgage Applications

Lower rates also have provided a nice lift for mortgage applications in recent weeks, especially for refinances, according to the Mortgage Bankers Association (MBA). Applications to refinance rose 4% from last week and were an enormous 81% higher than one year ago. Purchase applications dropped 5% from the prior week but still were up 20% from last year at this time.

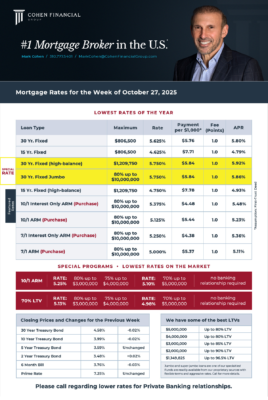

Mortgage Rates for the week of 10-27-2025