Mortgage Rates

Central bankers around the world maintained their aggressive stance on tightening monetary policy to fight inflation last week. As a result, mortgage rates reached the highest levels in over twenty years.

Home Sales Continue to Fall

Hurt by higher mortgage rates, sales of existing homes fell for the eighth straight month in September to the lowest level since 2012 (excluding a brief period early in the pandemic) and were 24% lower than last year at this time. Inventory levels were slightly lower than a year ago, at just a 3.2-month supply nationally. While the median existing-home price of $384,800 was 8% higher than a year ago, this was down from a record high of $413,800 in June.

Inventory Drop Lingers

A lack of inventory of homes has been a lingering issue, and relief from new construction continues to be painfully slow. In September, overall housing starts fell well short of expectations and were 8% lower than a year ago. Single-family starts were down a much larger 19% from a year ago, remaining near the lowest levels since early in the pandemic. A survey of home builder sentiment from the NAHB declined for the tenth straight month to 38, half what it was just six months ago, and the lowest reading since 2012 (excluding a brief dip in 2020). A level below 50 is considered negative. Higher prices and shortages for land, materials, and skilled labor remained major issues holding back a faster pace of construction.

Buyers Seek Lower Rates

Higher mortgage rates have also taken a large toll on mortgage application volumes, which are now at the lowest levels in 25 years. According to the latest data from the Mortgage Bankers Association (MBA), average 30-year fixed rates are now “well over” 3% higher than a year ago, at the highest level since 2002. Purchase applications are down 38% from last year at this time, and applications to refinance a loan have plunged a shocking 86% from one year ago. As buyers seek lower rates, the share of adjustable-rate applications climbed to 13%, the highest level since 2008.

Major Economic News Due This Week

While another 75 basis point rate increase is expected at the next Fed meeting on November 2, investors are hoping for more specific guidance on the pace of future rate hikes and bond portfolio reduction. New Home Sales will be released on Wednesday. Third quarter GDP, the broadest measure of economic activity, will come out on Thursday. The next European Central Bank meeting also will take place on Thursday. The core PCE price index, the inflation indicator favored by the Fed, will be released on Friday.

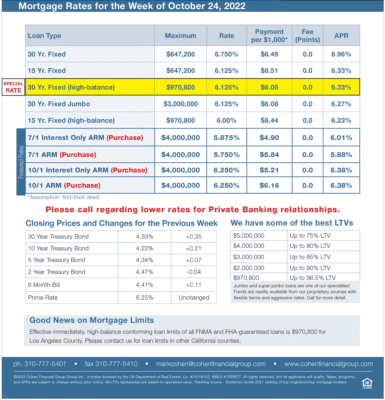

Mortgage Rates for the week of 10-24-2022