Mortgage Rates Hold Steady

Given the lack of major economic data due to the government shutdown, there was very little movement in mortgage rates last week, and depressed volatility is likely to continue until the shutdown ends. Mortgage rates remain near their lowest levels of the year.

Consumer Sentiment Declines

The latest survey on consumer sentiment published by the University of Michigan revealed that consumers remain concerned about the impact of higher tariffs and the government shutdown. The index dropped to 55, a little above the consensus forecast of 54, but the lowest level since May. The component of the report on inflation expectations showed that the five-year average outlook was unchanged at 3.7% per year.

Fed Minutes Highlight Divided Outlook

The detailed minutes from the September 17 Fed meeting released last Wednesday confirmed that nearly all officials supported the 25 basis point reduction in the federal funds rate due to labor market weakness. The main source of disagreement came from their forecasts for further monetary policy easing, with officials split almost evenly between one or two additional 25 basis point reductions before the end of the year. Investors are similarly divided, anticipating one more rate cut this year but not necessarily two. According to the minutes, inflation concerns were the primary reason that officials remain cautious about the pace of easing.

Mortgage Activity Slows

Even though rates remain near the lowest levels of the year, mortgage applications weakened last week, according to the Mortgage Bankers Association (MBA). Applications to refinance fell 8% from last week but still were 18% higher than one year ago. The share of adjustable-rate mortgages (ARM) for refinances climbed to 9.5% of total applications from 8.4% last week. Purchase applications dropped 1% from the prior week but were up 14% from last year at this time.

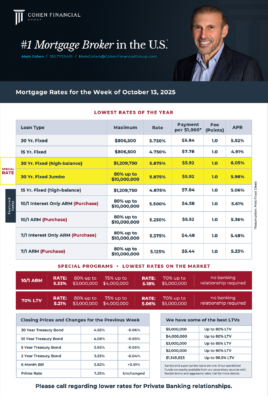

Mortgage Rates for the week of 10-13-2025