Last week, the highly anticipated labor market data did not ease investor concerns about inflation and additional Fed rate hikes. As a result, mortgage rates ended a bit higher.

U.S. Labor Market Remains Strong

While most of the closely watched Employment report released last Friday was right in line with expectations, one key element did not contain the results hoped for by Fed officials. Against a consensus forecast of 250,000, the economy gained 263,000 jobs in August. The best-performing sectors were leisure, hospitality, and health care, while government hiring fell. Average hourly earnings, an indicator of wage growth, were 5.0% higher than a year ago, down from an annual rate of 5.2% last month.

The one significant surprise was that the unemployment rate unexpectedly dropped from 3.7% to 3.5%, matching the lowest level in decades also seen in July. The decline was mostly due to people leaving the labor force, which is the opposite of what Fed officials would like to see. The desired outcome for the Fed is for more workers to begin seeking jobs, driving down wage inflation.

Job Openings Still Exceed 10 Million

In contrast, the JOLTS report released last Tuesday revealed signs that the extremely tight labor market may be starting to loosen. In August, job openings plunged to 10.1 million, far below the consensus forecast of 11.0 million. A lower level of openings means that it is easier for companies to hire workers with the required skills.

Consumers Shift to Services

Two other significant economic reports released this last week from the Institute of Supply Management (ISM) indicated that consumers are shifting their spending from goods to services. The ISM national services sector index came in at 56.7, which was stronger than expected. By contrast, the ISM national manufacturing fell to 50.9, below the consensus forecast and the lowest level since May 2020. Levels above 50 indicate that the sectors are expanding.

Major Economic News Due This Week

Going forward, investors are hoping for more specific guidance from the Fed on the pace of future rate hikes and bond portfolio reduction.

The Consumer Price Index (CPI) will be released on Thursday. CPI is a widely followed monthly inflation indicator that looks at the price changes for a broad range of goods and services.

Retail Sales will come out on Friday. Since consumer spending accounts for over two-thirds of U.S. economic activity, retail sales data is a key measure of the health of the economy.

Import Prices also will be released on Friday. Mortgage markets will be closed on Monday in observance of Columbus Day.

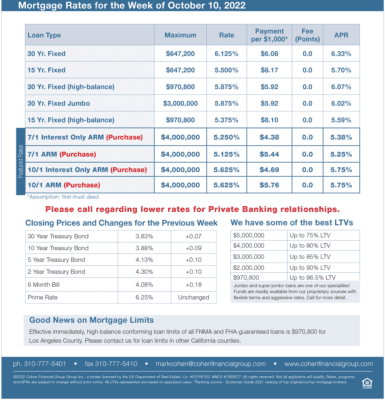

mortgage rates week of 10-10-2022