Positive Strong Economic Data

Strong data on consumer spending and the labor market raised the investor outlook for economic growth this year. This was negative for mortgage rates, which ended last week higher.

Consumer Spending Above Consensus

Despite higher prices and credit card rates, consumer spending remained strong during the holiday shopping period and again outperformed the forecasts of economists. In December, retail sales rose 0.6% from November, above the consensus for an increase of 0.4%. Retail sales are not adjusted for inflation yet were 5.6% higher than a year ago, exceeding the increase in prices over that period.

Easing of Labor Markets

The Department of Labor releases the total number of new claims for unemployment insurance each week, and the most recent reading was just 187,000, the fewest since September 2022. This was down sharply from the inflated figures seen during the early months of the pandemic and a little lower than the levels which were typical during 2019. Although some other recent economic reports such as nonfarm payroll growth and job openings have suggested some easing of labor market conditions, the data on jobless claims has remained consistently strong.

Existing Home Inventory Levels at Historic Lows

Sales of existing homes in December fell slightly from November and were 6% lower than last year at this time. Inventory levels remain stuck near historic lows, standing at just a 3.2-month supply nationally, far below the 6-month supply typical in a balanced market. The median existing-home price of $382,600 was 4% higher than last year at this time.

Future Housing Market Outlook

Additional inventory of homes continues to be badly needed in many areas, and the latest data was mixed. In December, single-family housing starts fell 9% from November (following a huge 18% increase last month) but still were 16% higher than a year ago. Single-family building permits, a leading indicator of future construction, rose to the best level since May 2022. In addition, a separate survey of home builder sentiment on housing market conditions from the NAHB unexpectedly jumped from 37 to 44.

Major Economic News Due This Week

Investors will continue to watch for Fed officials to elaborate on their plans for future monetary policy. For economic reports, New Home Sales and Gross Domestic Product (GDP), the broadest measure of economic growth, will be released on Thursday. Personal Income and the PCE price index, the inflation indicator favored by the Fed, will come out on Friday. The next Fed meeting will take place on January 31.

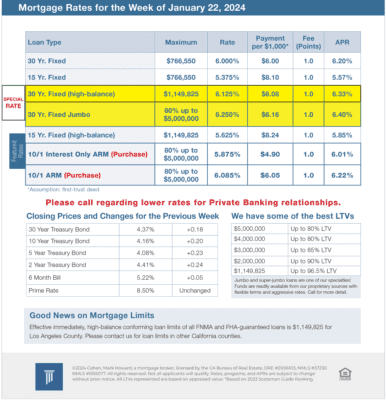

Mortgage Rates for the week of 1-22-2024