Concerned about higher inflation, investors focused on two major economic reports last week measuring consumer spending and inflation. While retail sales were much weaker than expected and CPI inflation a bit stronger, neither report caused much reaction, and mortgage rates ended last week with little change.

Consumer Spending and Retail Sales Bounce Back

Since consumer spending accounts for over two-thirds of US economic activity, it is an important indicator of the health of the economy. In December, retail sales plunged 1.9% from November, which was far below the consensus forecast for just a slight decline of 0.1%. Despite this recent weakness, however, sales rose an impressive 17% in 2021, recovering nicely from a tough 2020.

There are several factors which contributed to the drop in consumer spending at the end of the year. First, due to shortages of a wide range of products, consumers started doing their shopping sooner than usual, resulting in much stronger than expected spending very early in the holiday season. In addition, rising Covid case counts and surging prices caused people to scale back their purchases in December.

Core CPI reaches a 31-Year High

The Consumer Price Index (CPI) is a closely watched inflation indicator that looks at price changes for a broad range of goods and services. Core CPI excludes the volatile food and energy components and provides a clearer picture of the longer-term trend. In December, Core CPI was 5.5% higher than a year ago, up from an annual rate of increase of 4.9% last month, and the highest level since 1991. There are many reasons why the annual core inflation rate has jumped from the readings below 2.0% seen during the first few months of 2021, including a tight labor market, strong consumer demand for goods, rising energy prices, and supply chain disruptions.

Global transportation delays and component shortages for many items have caused enormous cost increases. Investors are divided about how much higher inflation is due to temporary factors caused by the pandemic or are more structural (long-lasting) in nature.

Major Economic News Due This Week

Looking ahead, investors will closely follow news on the omicron variant and will look for additional Fed guidance on the timing for future rate hikes and balance sheet reduction. Beyond that, it will be a light week for economic reports with a focus on the housing sector data. Housing Starts will be released on Wednesday, and Existing Home Sales will come out on Thursday. Mortgage markets will be closed today in observance of

Martin Luther King Day.

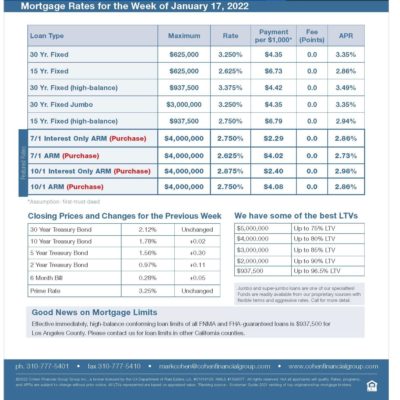

mortgage rates week of 1-17-2022